L’économie des plateformes en logistique La servitization d’un secteur de services ?

- Type de publication : Article de revue

- Revue : European Review of Service Economics and Management Revue européenne d’économie et management des services

2021 – 2, n° 12. varia - Auteurs : Müller (Stephan), Knitschky (Gunnar)

- Résumé : L’article aborde de manière analytique la question de savoir si une « servitization » issue de l’économie de plateforme se profile pour le secteur logistique. Si tel était le cas, cela serait essentiel pour les entreprises et les politiques publiques en raison de l’importance économique du secteur. Les modèles d’affaires de l’économie de plateforme peuvent être interprétés comme une nouvelle étape de développement des services logistiques. Mais, la symbiose entre les secteurs des TI et de la logistique est en train de se dissoudre et déboucher sur une relation de concurrence, avec une confrontation majeure : le secteur logistique va-t-il se doter de la compétence informatique nécessaire, ou est-ce le secteur informatique qui va construire la compétence logistique nécessaire ? Les stratégies des entreprises et les politiques publiques devraient se concentrer sur cette question.

- Pages : 17 à 34

- Revue : Revue Européenne d’Économie et Management des Services

- Thème CLIL : 3306 -- SCIENCES ÉCONOMIQUES -- Économie de la mondialisation et du développement

- EAN : 9782406122616

- ISBN : 978-2-406-12261-6

- ISSN : 2555-0284

- DOI : 10.48611/isbn.978-2-406-12261-6.p.0017

- Éditeur : Classiques Garnier

- Mise en ligne : 27/10/2021

- Périodicité : Semestrielle

- Langue : Anglais

- Mots-clés : modèles d’affaires, secteur des TI, services logistiques, économie de plateforme, servitization

Platform economics in logistics

Servitization of a service sector?

Stephan Müllera

Gunnar Knitschkya

aGerman Aerospace Center, Institute of Transport Research, Germany

Introduction

Digitisation in the sense of a digital transformation is a trend that has been strongly changing traditional industries, products and processes for two to three decades. One side of digitalisation concerns the business model in the form of so-called platforms. Numerous economically significant service markets have already been dominated and monopolised by platforms, or the traditional market structures are currently being broken up. This development has strong effects on economic indicators such as employment, value creation and competition for the sectors concerned. One can speak of a servitization of the established markets and market participants. Examples of this are the retail market through online retailers, the credit card market through digital payment systems, and the travel market through room brokerage platforms. In the field of mobility, too, there are now examples such as the long-distance bus market and the numerous platforms that offer mobility services with cars, scooters or bicycles.

In logistics, too, platforms bring dynamism to the markets. Thousands of platforms have been founded in the past decade (Friedrich et al., 2017). Using the example of FedEx, CBinsights shows that the elements of 18the service are almost completely and partly already offered by several platforms in competition1. The example of SENNDER shows that in the capital markets, platform economy business models in logistics are receiving affirming rounds of financing and valuations2. On the other hand, “platforms” have already been established by the industry itself in traditional logistics through spot marketplaces, eForwarders, transport management platforms, tendering platforms, visibility platforms and supply chain management platforms3. Fourth party logistics providers (4PLs) can also be interpreted as platforms because they merely broker logistics services. The basic principle of a platform, namely the mediation of supply and demand, is thus already established in logistics as a business concept of individual market participants.

There is thus uncertainty as to whether the traditional logistics industry is threatened (“servitized”) by platforms or whether it has even created the platform economy business model in its market itself. There is therefore a need for an analysis of the economic space of platforms in logistics. This is of great relevance not only for strategic decisions of companies but also for public policy. Against this background, this article mirrors the characteristics of platform economy business models with the characteristics of logistics services. It works analytically-argumentatively on the question of whether servitization is imminent for the sector. First, we characterise the economic basis of logistics service and innovation competition in the logistics sector. Then we reflect the characteristics of platform economy business models on the characteristics of the logistics market. In the conclusion, entrepreneurial and political strategies are discussed on this basis.

191. Logistics as a service:

character of the innovation process

Logistics is a service, but what characterises and determines it and what development tendencies does it have based on its characteristics? This paper serves to understand the core of the service concept of the logistics industry and its dimensions of product development. For this purpose, the development of transport logistics is described aggregated over time and thus the core of service and the innovation process in the industry becomes apparent. We start in the time before truck-based logistics: around 1880, the economy and economic interaction was geared towards the efficiency of the railway transport system. In concrete terms, this means that mass production in central locations was the dominant economic concept of the first industrial revolution. The basic input factor of any production was the raw material coal for the operation of steam engines. The output was shipped in batches of railway wagons or entire trains. Inevitably, these production sites had to be located along railway tracks, which led to the spatial development of cities with simultaneous urbanisation along the railway axes.

The second industrial revolution from 1880 onwards was driven at its core by innovations in electrical engineering. Machines were no longer powered by coal-fired steam engines on site but were supplied with the necessary energy via electric cables. This made possible a) other locations of production far away from railway tracks and large cities, b) smaller machines also allowed the economic production of smaller production units, and finally c) at the beginning of the 20th century, a stronger division of labour through specialisation led to so-called Fordist production. This led to a succession of new demands for transport. To meet this demand, a) the railway network was enormously expanded and served by countless branch lines, and b) the railways were electrified, which gave them a significantly higher systemic capacity. But this transport system was designed for mass and paired transport. Despite the innovative tendencies, it lost economic viability the more transport demand became individual, small scale and spatially dispersed. For this emerging transport demand, the truck was the more efficient means of 20transport and after the world wars, the economy and trade were geared to the truck’s performance: small-scale transports between decentralised locations of production and trade.

In the period from 1930-1940 to 1980-1990, the truck is the technological core of logistics and acts as a driver of economic development (long economic wave, Kondratieff cycle of automotive) (Freeman and Perez, 1988). During this time, transport and storage were essentially parts of internal company processes in the form of incoming goods warehouse – production process – outgoing goods warehouse – transport to the customer. For political reasons, the transport and forwarding industry was severely restricted by market access, capacity and price regulations (including concessions and tariffs). The companies circumvented these restrictions by means of internal transport logistics (own-account transport). However, this logistics was relatively cost-intensive because vehicles and personnel had to be kept available and production concepts were geared towards using these (means of production) economically.

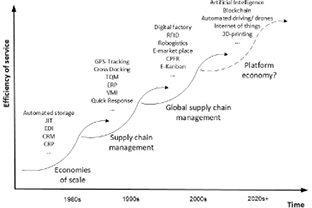

From the 1980s, at the same time as the deregulation/European harmonization of road freight transport, logistics with its core processes of storage, handling and transport became a service. The economic justification for the emergence of the service is that logistics, due to its specialisation and economies of scale, was able to offer more efficient storage, handling and transport than the individual companies on their own. Economies of scale are particularly large the more companies use the service of a provider. Technologically, IT was generally used in the processes for higher efficiency. Examples are electronic data interchange (EDI), the use of production planning control systems (PPS) and systems based on them such as the continuous replenishment program (CRP), IT-based Kanban systems, production planning system (PPS), just-in-time, materials requirement planning (MRP), customer relationship management (CRM), customer relationship planning (CRP) and, in addition, warehouse technology was started to be automated.

From the 1990s onwards, logistics developed into a service that optimised value chains. The network effect was extended to suppliers and customers of the core customers of the logistics industry. Not only was the potential of the scale effect increased, but the production of companies was also aligned with the logistical requirements of value 21chains. Lower capital commitment through reduced storage was a major efficiency driver. In the economic logic of network effects, the more stages of a product’s value creation process were integrated at the logistics service, the more efficiency could be increased. For complexity reduction and efficient resource allocation, new tools became necessary and crucial to deliver the service. Concise examples of organisational innovations include enterprise resource planning (ERP), process modelling tools, business intelligence tools, total quality management (TQM), enterprise resource planning (ERP), efficient consumer response (ECR), advanced planning systems (APS), vendor managed inventory (VMI) and quick response. Major technological innovations were cross docking, GPS tracking, the internal networking of companies using local network technologies and data transmission, as well as decentralised IT tools to promote communication processes.

From around the turn of the millennium onwards, the phase of global integration of value chains began, taking socio-economic factors into account. The efficiency potential in the network, which was expanded to a global scale, lies in the fact that comparative cost advantages of global production sites were integrated into logistics planning. In other words, if production, including transport, is cheaper in one place in the world than in another, the decentralised (global) value chain is economically worthwhile. In this phase of logistics, global value chain management, the organisational innovations of the previous stage could be used, and technological innovations were added as a matter of priority. IT-supported collaborative planning forecasting and replenishment (CPFR), virtual warehouses and “robogistics” led to the end of this phase that logistics could in fact be automated and digitalised throughout – except for the driving process.

One can interpret the current trend towards the platform economy in logistics as a new phase in which a new level of network effects (the more providers, the more demanders on platforms, and vice versa) are realised with simultaneously low transaction costs for the mediation of providers and demanders. Friedrich et al. (2017) shows over 5,500 start-ups in the last 10 years, most of which operate in the logistics and transport markets. In addition, the core competences of the start-ups are in the areas of IT, automation, robotics and social media. The in-depth analysis of some start-ups by Friedrich et al. showed that most of the 22start-ups had no logistics experience before founding the company. Technologies discussed or already used for this phase of logistics are automation of the driving process, blockchain, big data techniques, predictive analytics, artificial intelligence, internet of things, cloud computing and 3D printing.

From the developments so far, it can be concluded that efficiency is the core of logistics services and the central criterion of innovation competition between the companies offering them. Efficiency is not only measured in terms of costs, but also in terms of quality criteria – strikingly defined with the 7-rights according to Plowman (1964) (right quantity, right time, right cost and so on). The increase in efficiency as a central innovation process can be reduced to two central rules in the case of logistics: (1) Efficiency through network effects (economies of scale): the more companies use the service, the more efficiently a logistics company can provide its service; and (2) Efficiency through organisational innovations and technology innovations: the more a logistics company is oriented towards the service and is supported by corresponding technologies, the more efficiently this company can provide its service.

Figure 1 shows the innovation process of the logistics industry from the 1980s onwards, the period in which the “logistics” service sector developed. The dynamics of innovation competition are characterised by the stages of network effects and process innovations, or process innovations according to Renning (2000): less input and/or increased output of company processes through these innovations. The simultaneous rise of IT as a general driver of efficiency (Djellal, 2000), made IT an important technological and organisational companion of the innovation process in logistics. One can speak of a hitherto existing symbiosis of the logistics sector and the IT sector. On the one hand, platforms seem to be part of the natural development path of the sector. They offer a new level of efficiency in the market offer and this concerns the core of the service “logistics”. On the other hand, it needs to be analysed in more detail whether the characteristics of digitalised platform economy business models (by outsiders) could unfold in logistics.

23

Fig. 1 – Innovation process of the logistics industry.

2. Platform economy business models in logistics

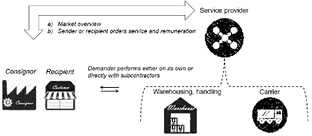

The logistics sector can be divided into four levels according to the number of parties involved: (1) First party logistics provider (1PL): the logistics unit in companies with the tasks of transport, handling and storage, logistics takes place in the self-entry of a company; (2) Second party logistics provider (2PL): like 1PL, except that service providers such as haulage companies are used for this; companies no longer do their own logistics, but outsource this function to external service providers and in a sense, 2PL is the system boundary to the logistics sector; (3) Third party logistics provider (3PL): in addition to the tasks of transport, handling and storage, additional services are carried out such as clearing goods and accepting returns; and (4) Fourth party logistics provider (4PL): logistical services are provided without any tangible assets of their own, purely as an intermediary activity.

24The established logistics industry operates in classic (one-sided) markets. There is an organised meeting of suppliers and demanders. Suppliers are companies that offer logistics services, while demanders can be recipients or consignors of goods. Recipients or consignors of goods obtain an overview of the market by contacting individual suppliers. The 2PLs and 3PLs act by commissioning the logistics service providers through a consignee or the shipper of goods (see Figure 2). Although intermediation already occurs in 4PLs, this is also a one-sided market, as the logistics service provider accepts an order from the consignor or consignee, but then specifically searches for possible service providers. The risk that the service can be provided profitably remains with the 4PL. This “one-sided” view of markets has been supplemented for certain market events. Two-sided or multi-sided markets are spoken of when an organisation links two or more different groups of actors and enables direct interaction between these sides. These organisations are referred to as platforms (Bundeskartellamt, 2015).

Fig. 2 – Principle of the one-sided market in logistics.

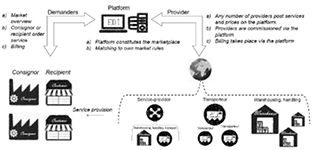

The concept of the platform economy is closely linked to a two-sided market, i.e. a service created on the market that carries out matching between suppliers and demanders (Rochet and Tirole, 2006). Online platforms use algorithms to control the functions of a market, such as information on demand and supply, pricing, costs of market participation and market access. In a two-sided market in logistics, the platform represents the marketplace. Providers (forwarders, transporters) 25offer their services on this marketplace. The platform makes services and prices (prices from the service provider plus, if applicable, pricing by the platform) transparent for customers. The platform’s algorithm determines which services are displayed to the buyer at which conditions. Demanders order a service via the platform and also charge for it via the platform (Rožman et al., 2019) (see Figure 3).

Fig. 3 – Principle of the two-sided market in logistics.

In logistics, the specialised knowledge and organisational competence of “the forwarder” is crucial to ensure that the right product, in the right condition, is at the right place at the right time. In the course of the digitalisation wave, technologies and principles are developing that could take over the competence of the forwarder. Specifically, the technology area of IT with learning algorithms, big data, artificial intelligence, the Internet of Things and cloud computing are becoming relevant for these areas of application. In general, digital platforms can be characterised by the following properties: network effects, scalability, market concentration tendencies, and integration. To analyse which effects of platforms on established logistics are fundamentally likely and how a business model can be fundamentally designed, the economic characteristics of platforms are discussed and applied to the logistics market.

262.1. Network effects

The benefit of a good usually increases as the number of users increases (positive network effects). This aspect is of central importance for platforms. A platform becomes more attractive for providers the more demanders actively use the platform. Conversely, the more providers are represented on a platform, the more attractive it is for demanders. The attractiveness and value of a platform thus grow with the number of its customers on both sides of the market. For a new platform entering the market, it is therefore essential to quickly exceed a critical mass of users. The attractiveness for users is reflected in the broader selection of different user types (variety effect); the faster matching of supply and demand results in an increase in efficiency (efficiency effect). If the effects occur within the market/one side of the market, we speak of direct network effects. Indirect network effects refer to effects between different market sides. Indirect network effects in particular have an impact on the attractiveness of the platforms by increasing the use of the network by the other user group.

The logistics market is characterised by a “polypolistic” market form; a high number of transport companies is contrasted by a much higher number of (production) companies that generate transport demand. Typically, in established logistics, logistics services are put out to tender, there are framework agreements, or the client falls back on its past-oriented special knowledge. Digital tendering reduces searches for suitable service providers as well as time-consuming requests for proposals from various providers. Network effects for the participants of the logistics platform thus result from a higher selection benefit, because they are given a better and faster market overview. In addition, a more favourable price results for the market participants. At the same time, the verification and evaluation of the services provided by business partners provides a check and makes it possible to assess potential partners in advance. This reduces the search costs and thus the transaction costs for concluding a contract. The matching efficiency on the transport market increases. Through bundling and consolidation effects, existing loading capacities can be better utilised. This reduces the marginal costs of the logistics service and thus also the price for the customer.

272.2. Scalability

In business management, scalability refers to the increase of capacities with a simultaneous very small increase in the resources required for this. Characteristics of scalability are a high degree of automation, low proportions of fixed costs, an asset-light strategy and an ability to expand, i.e. to extend to other markets. Compared to traditional logistics, setting up and operating a platform requires comparatively low investment costs for infrastructure (PCs, servers and similar IT infrastructure) and thus low fixed costs. Cost drivers of a capacity increase in “production” would be present here in the non-existence of factors in the form of communication and transaction costs. Even taking into account the amplification of network effects, there is therefore a tendency for platforms to aim for rapid growth and to act as a global enterprise.

On the supply side, scalability reaches its limit when special services can no longer be described by the offer of the general service and only an independent platform can fulfil this service with a higher customer benefit. In principle, the pure brokerage offer of logistics services is fully scalable. Many transport services are standardised within the scope of standard forwarding activities; the transport contract is often concluded on the basis of general terms and conditions – for example, in Germany, the 2017 German Freight Forwarders’ Standard Terms and Conditions (literally translated). The pure intermediary role already required only a telephone in traditional logistics and is only marginally more capital-intensive today with an IT infrastructure.

The logistics market is a distinctly international market. One challenge lies in observing and thus overcoming national regulations and standards in order to be able to contractually fix the service in a legally valid cross-border manner. The legal framework with rights and obligations, especially liability, is fundamentally defined by international regulations and standards. However, national rights and obligations also apply to international transports. Scalability reaches its limit when national differences cannot be overcome, for example in the case of special national regulations or services. Within a uniform economic area, such as the European Union or the United States, scalability should be given. For certain sub-markets of logistics (such as sea freight, air freight, heavy lift), specialised platforms may be needed that can more 28accurately reflect the specificity of these markets, but whose scalability is limited to the sub-market.

2.3. Tendency of market concentration

The market dynamics induced by network effects can lead to individual platforms assuming a dominant position and establishing themselves as a quasi-natural monopoly in the market. A market concentration of platforms is particularly likely if a) the network effects are particularly strong (for example in online auctions), or b) the transaction costs when switching between platforms are high. Economies of scale in particular lead to falling average costs and can therefore be a cause of concentrations of platforms. Multihoming is another important aspect and concerns the possibility that actors of a group (suppliers and demanders) can use several platforms in parallel. This is particularly the case when transaction costs are very low and when supply and demand are not mutually exclusive; for example, a product can only be offered at one auction, but a hotel room can be offered on several platforms as long as it is available. When economic conditions favour multihoming, meta-platforms are often formed that bundle the supply and demand of competing platforms. Such meta-platforms in turn show monopolisation tendencies. The logistics sector as a whole is generally characterised by low barriers to market entry, so that the markets are in principle contestable, also due to changing user preferences. Standardised transport services differ only marginally and are therefore substitutable. The sum of all services on different platforms are comparably similar (in contrast to the sale of one-off goods at online auction). It can therefore be assumed that several large platforms can exist and that further platforms do not reach the critical limit of users.

Multihoming on logistics platforms is unlikely for the time being because it requires standardised interfaces for the participants of a platform, for example regarding order data, capacities, locations and contracts. This requires a technical facility for the collection, standardisation and transmission of data (for example, for vehicle position, utilisation, order data, etc.). For platforms, the fact that they can define their own standards offers the possibility to differentiate themselves from other platforms and thus also to differentiate the platform from meta-platforms. A switch between platforms thus causes transaction costs for the participant and 29only takes place if the expected benefit (including potential savings) in the case of a switch is higher than the costs incurred. Assuming that the price spread of the alternative offers is low, a switch will probably not take place. The exclusion through standards (possibly supported by special assets) appears to be economically necessary for platforms to survive so that the competitive situation can be influenced. In order to achieve further network effects, it is to be expected that logistics platforms enter into innovation competition and price wars with each other. The platform with the better capitalisation for innovation and pricing is most likely to achieve a dominant position.

2.4. Integration

Vertical and horizontal integration is beneficial for platforms. Both the takeover of upstream and downstream activities in the form of complementary services, products or value creation stages and the merger with platforms of the same level increase user attractiveness. This allows direct network effects to be realised, and reinforces the indirect network effect. In the end, platforms tend to become multi-platforms in order to be able to hold their own. The medium-sized logistics sector is strongly integrated both horizontally and vertically. In this highly developed market, the vertical integration potential decreases and the (transaction) costs of integration increase (law of diminishing marginal returns). Platforms geared towards standardised transport brokerage must expand their portfolio of offerings to include additional services in order to increase their attractiveness and create further additional benefits.

Where standard logistics and transport products have emerged (with a tendency towards price wars due to the substitutability of homogeneous products), the situation may also arise where logistics is integrated into existing platforms. The tendencies towards digitalisation and standardisation of logistics services may favour this. Giant retailing platforms, for example, are also integrating transport logistics into its platform by building a proprietary infrastructure for (transport) logistics that is aligned with its own distribution model (for example, speed delivery). The ongoing “back sourcing” of companies, the reintegration of logistics expertise into the company, can also have a favourable effect on the market relevance of platforms if the platforms are used to plan and implement the company’s own value chain more efficiently in terms of 30transport technology. Platforms thus reduce the complexity and costs of back sourcing. Thus, back sourcing is not in the sense of rebuilding one’s own logistics infrastructures, but as logistics competence for the use and control of existing resources on the market (for storage, handling and transport).

2.5. On the other hand: further aspects

However, there are also arguments against the potential success of platforms in logistics. Only a part of logistics activities are standardised transport services. The complexity of logistics extends from frequent changes in quantities and types of goods, information and goods flows to transport, handling, storage, packaging and signing processes (interactive customer requests, ad hoc change requests regarding delivery, returns management, handling of load carriers such as pallet management). These activities require specialised knowledge, especially for planning, but also for management and control. A platform designed for a high number of contingencies and thus many degrees of freedom increase diversity, but at the same time also complexity and thus production and transaction costs for the platform operator.

Also important are low transaction costs due to personal trust on the part of the supplier and the buyer. In this context, trust is considered an important factor in reducing transaction costs through shortened negotiation time, lower control costs and as an understanding of risk. A major argument is devoted to the established key role of logistics in production and trade processes. The security of the logistics chain for production and trade processes is the top priority, which the other logistics objectives must serve. A platform would have to provide this trust and ensure security.

2.6. Discourse of legal implications

using the example of Germany

It can be assumed that a progressive integration of services into a platform would have an impact on the business models of the platform operators. In addition to the creation of added value – in this case the matching of data sets – the success of a business is closely linked to the offer of obvious services that provide the user with tangible added value, for example insurance or organisation of arrival/departure (=travel agency) 31on the platform of a housing agency. As long as only the platform for brokering transport orders is provided, the platform’s activity is classic freight brokering in the sense of a commercial broker according to Section 93 ff Handelsgesetzbuch (HGB), the German Commercial Code4. According to Section 93 HGB, a commercial broker is: “(1) Any person who, on a professional basis, undertakes the brokerage of contracts for the purchase or sale of goods or securities, for insurance, for the carriage of goods, for the hire of ships or for other items of commercial traffic on behalf of other persons, without being permanently entrusted with this task by them on the basis of a contractual relationship, shall have the rights and duties of a commercial broker” (literally translated)5.

The activity of the freight broker is not subject to any authorisation requirement under road haulage law. It is not a party to the freight transaction and therefore not involved in the contract of carriage, and not responsible for the performance of the transport. However, it is only a freight brokerage if the freight contract is concluded between the carrier and the principal and the freight broker only receives a commission from one of the two parties. This leads to the fact that as soon as additional services (activities customary in freight forwarding) are offered by the platform than the actual brokerage, for example optimisation and communication, combining orders into tours, traffic-dependent logistics planning, etc., the regulations with the rights and obligations for freight forwarders according to Section 453 ff HGB apply, as well as further standards. The platform would then be on an equal footing with a classic freight forwarder. On the one hand, this problem shows the discrepancy between the traditional regulations (of the commercial law) and the function of platforms in the digital world and a possible need for adaptation. On the other hand, the traditional regulations prove to be stable even for the digital world. The fact that this may not always be in the interest of the platform providers is another matter.

32Discussion and conclusion

We have described the innovation competition in the logistics industry and discussed the characteristics of platforms for the logistics market. We can conclude from the analysis that platforms tend to be part of the natural development path of the industry. This results from the larger network effects of platforms, a core of the innovation competition in the industry since the beginning, and from the economic arguments of platforms that bring advantages for the service “logistics”. An assertion of digital platforms in the logistics industry can thus be expected in the long term. Particularly in the case of standardised transport services, a displacement of the classic forwarding business model by transport platforms is likely. In principle, the initial conditions such as the legal situation, the complexity and the requirements for secure logistics chains point to a barrier to entry for platforms. However, it is probably only a matter of time before this barrier can be overcome. The servitization of the services sector is thus to be expected.

It is still open, however, whether large logistics companies will become platform providers today or whether newcomers will find the platforms. In the latter case, incumbents today would be pushed into a pure provider function. The companies with their own assets would have market rights, including small and medium-sized enterprises; today’s asset-free logistics companies would probably become obsolete. Non-standardised logistics services tend to be difficult to map on platform economy business models. Overall, these results point to the following strategic aspects in the sector. Firstly, the symbiosis between the IT sector and the logistics sector that has prevailed for decades seems to be turning into a competitive situation. The “simple” question is whether the established logistics sector will manage to quickly build up the necessary IT competence or whether the IT sector will manage to build up the necessary logistics competence more quickly. There is a danger that an innovator’s dilemma situation will arise for the logistics industry (Christensen, 1997): the established innovation path in the core market will be intensified (focus on the more efficient logistics of global value chains), although disruption is foreseeable (logistics as a standard 33element for higher-level individual services). Experience shows, however, that this strategy of intensification is doomed to failure. Important strategic entrepreneurial tasks thus consist of either a) concentrating on building platform economic competence (including IT!), or b) preparing an orderly retreat into profitable niches.

It can be assumed that platforms will prevail in logistics, therefore it would be advantageous to locate platform services in one’s own economy. Even if there is a tendency to resist platforms in established market structures in individual industries for understandable reasons, this approach seems inappropriate for the logistics sector. Rather, it is worthwhile to set a framework that a) supports a conversion of established business models, and b) supports the socio-economically balanced location of platforms in their own national economy (or at least in Europe). By socio-economically balanced we mean the – often criticised – practices of already existing platforms in other markets regarding taxes, working conditions, wages, etc.

34References

Bundeskartellamt (2015), Digital economy: Internet platforms between competition law, privacy and consumer protection, Background Paper to the Meeting of the Working Group on Cartel Law, Bonn.

Christensen C. (1997), The innovator’s dilemma: when new technologies cause great firms to fail, Boston (MA), Harvard Business School Press.

Djellal F. (2000), “The rise of information technologies in ‘non-informational’ services”, Vierteljahrshefte zur Wirtschaftsforschung, Vol. 69, No. 4, p. 646-656.

Freeman C. and Perez C. (1988), “Structural crises of adjustment, business cycles and investment behavior”, inDosi G., Freeman C., Nelson R., Silverberg G. and Soete L. (Eds.), Technical change and economic theory, London, Pinter, p. 39-62.

Friedrich H., Staudinger A., Ludwig A. and McKinnon A. (2017), “A taxonomy of start-ups in the logistics industry”, Proceedings of the 3rd Interdisciplinary Conference on Production, Logistics & Traffic, Darmstadt, p. 1-3 (CD-rom).

Plowman E. (1964), Lectures on elements of business logistics, Stanford (CA), Stanford University Press.

Rennings K. (2000), “Redefining innovation-Eco-innovation research and the contribution from ecological economics”, Ecological Economics, Vol. 32, No. 2, p. 319-332.

Rochet J.-C. and Tirole J. (2006), “Two-sided markets: a progress report”, RAND Journal of Economics, Vol. 37, No. 3, p. 645-667.

Rožman N., Vrabič R., Corn M., Požrl T. and Diacia J. (2019), “Distributed logistics platform based on blockchain and IoT”, Procedia CIRP, Vol. 81, p. 826-831.

1 https://www.cbinsights.com/research/startups-unbundling-fedex/ (Accessed April 20, 2021).

2 https://smp.law/EN/Press/SMP_advises_Project_A_on_investment_in_Sennder_in_160_million_round.php (Accessed April 20, 2021).

3 https://www.bvl.de/blog/die-plattform-okonomie-chancen-und-herausforderungen-fur-den-wirtschaftsbereich-logistik/ (Accessed April 20, 2021).

4 https://www.gesetze-im-internet.de/hgb/__453.html (Accessed April 16, 2021).

5 In the following paragraphs, Section 93 HGB reads: “(2) The provisions of this section shall not apply to the brokerage of transactions other than those designated, in particular to the brokerage of transactions in immovable property, even if the brokerage is carried out by a commercial broker. (3) The provisions of this section shall also apply if the nature or scope of the commercial broker’s business does not require a business operation set up in a commercial manner”.