Les dimensions clés pour évaluer la compétitivité des services aux entreprises intensifs en connaissances

- Type de publication : Article de revue

- Revue : European Review of Service Economics and Management Revue européenne d’économie et management des services

2020 – 1, n° 9. varia - Auteur : Hernandez Eleno (Estibaliz)

- Résumé : Les services aux entreprises intensifs en connaissances (SEIC)) jouent un rôle central dans la compétitivité des économies mondiales. Dans cet article, nous proposons un modèle général pour évaluer la compétitivité des SEIC au niveau de l’entreprise. Le modèle est composé de quatre dimensions intra-organisationnelles, ayant chacune une orientation interne et externe: l’innovation, le talent, le capital relationnel et la proposition de valeur pour le client. Le modèle a été testé dans 75 entreprises de SEIC pour déterminer dans quelle mesure ces quatre dimensions sont des éléments clés de la compétitivité.

- Pages : 77 à 96

- Revue : Revue Européenne d’Économie et Management des Services

- Thème CLIL : 3306 -- SCIENCES ÉCONOMIQUES -- Économie de la mondialisation et du développement

- EAN : 9782406106043

- ISBN : 978-2-406-10604-3

- ISSN : 2555-0284

- DOI : 10.15122/isbn.978-2-406-10604-3.p.0077

- Éditeur : Classiques Garnier

- Mise en ligne : 06/05/2020

- Périodicité : Semestrielle

- Langue : Anglais

- Mots-clés : Services aux entreprises intensifs en connaissances, compétitivité, innovation, talent, capital relationnel, proposition de valeur

KEY DIMENSIONS FOR ASSESSING KNOWLEDGE INTENSIVE BUSINESS SERVICES’ COMPETITIVENESS

Estibaliz Hernandez Elenoa,b

aMondragon University –

Faculty of Business Studies

bMIK – Mondragon Innovation & Knowledge

Introduction

The objective of the paper is to present a preliminary model to assess Knowledge Intensive Business Services’ (KIBS’) competitiveness from an intraorganizational perspective, that is to say, the research has focused on analysing internal organizational aspects of KIBS companies. We have carried out an exploratory research on 75 companies of the Basque Country (Spain). In this paper, we present initial results of this research-in-progress.

Recent publications coincide in highlighting the expansion and growth of this type of services, from both a quantitative point of view (e.g. Chadwick, Glasson and Lawton Smith, 2008; Pina, 2016), as one of the fastest growing sectors in terms of its contribution to the GDP of the most advanced economies, and from a qualitative and empirical perspective, since the intrinsic characteristics of service companies significantly affect the creation and dissemination of knowledge in other economic sectors (Gallouj, 2010).

78Academic literature has focused primarily on the description of KIBS companies based on their conceptual characterization (Consoli-Elche-Hortelano, 2010; Doloreux, 2009; Hipp, 2000; Miles et al., 1995), their beneficial effects on client-firms competitiveness (Bettencourt et al. 2002; Den Hertog, 2000; Tether, Tajar, 2008), and their impact on innovation systems (Corrocher and Cusmano, 2014; Corrocher et al. 2008; Muller and Zenker, 2001). However, there are not enough theoretical development to determine the intrinsic characteristics of KIBS at the firm level: management practices, organizational structure, necessary resources, key activities and capacities that make some KIBS more competitive than others (Castaldi et al. 2013; Pina, 2016).

Although studies have been carried out to measure competitiveness at a quantitative level (Corrocher et al., 2008; Kamp, Ruiz de Apodaca, 2013; Santos-Vijandé et al., 2013), analyzing the inputs and outputs to determine KIBS innovation performance, there is no assessment model for KIBS that, in an holistic way, combines all the factors that scientific literature identifies as fundamental in order for KIBS to be competitive.

Following the compilation made by Pina (2016), these empirical studies mostly use a single performance variable to measure their competitiveness (Ferreira et al., 2013; Hitt et al., 2006) and only a few use multiple variables that cover various dimensions to explain knowledge intensive business services competitiveness (Boxall and Steeneveld, 1999; Reid, 2008; Valminen and Toivonen, 2012). This diversity of approaches, together with the absence of a strong theoretical justification of the variables used, reveal a certain lack of methodological coherence, which makes comparison between the various studies difficult (Pina, 2016). In fact, from the analysis of the state of the art, the lack of consensus regarding the definition of KIBS performance and the key dimensions of their competitiveness is evident (Merrilees et al., 2011; Santos-Vijande, 2013).

791. Conceptual framework

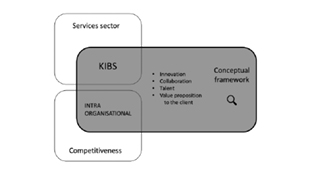

The conceptual framework seeks to be synthetic in its approach, as part of the literature reviewed is related to KIBS and another part is related to business intraorganizational competitiveness as shown in Figure 1.

Fig. 1 – Conceptual framework.

The approach of the research is based on the dynamic capabilities view. As many authors state, at the organizational level and in highly volatile environments, one of the perspectives that most clearly reflects the value of the capabilities, resources and knowledge needed to generate a long-term competitive advantage, is the theory of the dynamic capabilities of the firm (Den Hertog, 2010; Eisenhardt and Martin, 2000; Teece, 2007; Teece et al., 1997, 2009; Vivas-López, 2013; Winter, 2003). This approach, (also known as dynamic capabilities view (DCV)) is chosen in order to identify the prevailing routines, capabilities that foster competitiveness in KIBS.

Knowledge-intensive business services are private companies or organizations having a high degree of professional knowledge or expertise 80related to a specific area and offering intermediary services to other companies (Den Hertog, 2000; Miozzo and Grimshaw, 2005). They are highly innovative, more than any other type of service company (Miles, 1995; Muller and Zenker, 2001); they provide high quality services with high intellectual added value (Muller and Zenker, 2001); they use knowledge as their main input and produce knowledge as their main output (Gallouj, 2002), and their activities result in the creation, accumulation and dissemination of knowledge with the purpose of developing highly personalized services or solutions (Javalgi et al., 2011; Muller and Doloreux, 2009; Murray et al., 2009; Santos-Vijandé, 2013). The term KIBS refers to specialized and knowledge-intensive service companies that provide their services to enhance the processes of other companies (Potter, Martinez-Fernandez, 2015). They complement the production process of their client companies, providing specialized knowledge, advanced technologies and innovative strategies (Miozzo and Grimshaw, 2005).

Since they are considered the most innovative agents in the services sector, KIBS are relevant to economic prosperity, mainly due to their influence on the innovation activities of the sectors of their client-companies, usually manufacturing (Camacho and Rodriguez, 2005; Miles et al., 1995). Several authors define them as the main driver of modern services-based economies (Wei, Yan, Jiangqi, 2008), due to the dynamism of the sector and its impact on the competitiveness of their client companies and, therefore, throughout the economy (Miles, 2005).

Innovation is a concept inextricably linked to KIBS. In the economic and managerial literature, substantial work has been devoted to the understanding of KIBS’ influence on the innovative capabilities of the clients, but relatively little on their own innovation process (Muller et al., 2012). Innovation in KIBS is not based on the traditional conception of innovation linked to internal R&D activities, as is the case of manufacturing. The type of innovation related to KIBS is associated with structural issues such as: organizational change, incremental improvements carried out by highly qualified personnel and close collaboration with local customers and suppliers (Müller and Doloreux, 2009; Tether and Hipp, 2002).

KIBS help firms to innovate (Miles et al., 1995; Tether and Tajar 2008), generally by means of open and distributed innovation processes (Chesbrough, 2003; Coombs et al., 2003). There are several studies that 81highlight the importance of collaboration for innovation (Camarinha-Matos et al., 2013; Lee and Miozzo, 2019; Pittaway et al., 2004).

Evidence of this is the growing number of patents registered jointly in high-tech industries worldwide (OECD, 2008), and, in particular, the fact that about 20 % of the innovations in products and services registered by European companies in the Community Innovation Survey (CIS), have been carried out by other companies. This can be explained by rising production costs, rapid obsolescence and the complexity of the innovation activity itself, all of which have encouraged companies to find partners with whom to share resources and who complement their expertise (OECD, 2009, 2010).

In this sense, various experts are fully convinced that KIBS are true agents of innovation (Larsen, 2000). A study carried out by Battisti, Gallego, Rubalcaba and Windrum (2015) showed that the most radical innovations in the field of services occurred in knowledge-intensive sectors, closely linked to human capital-related capabilities, such as R&D, legal and financial services, engineering, design, advertising, market research and consulting.

A great number of studies have also addressed the role of KIBS in customer innovation activities (Bessant and Rush, 1995; Miles, 1999) and in local and national innovation systems (Den Hertog and Bilderbeek, 2000; Kautonen, 2001).

Close collaboration with clients, co-creation and customisation are one of the most noteworthy patterns of KIBS (Den Hertog, 2001; Miles et al., 1995; Strambach, 1994; Tether et al., 2001). Service is delivered following a co-creation logic: since knowledge is an essential factor, KIBS have two producers instead of one: the service provider, who contributes with intellectual capital, and the client firm whose input is informational resources and knowledge about itself (Doroschenko, 2012).

Service activities of KIBS firms are complex, unstructured and highly customized (Bettencourt, 2012). Therefore, the role that the clients play is fundamental, since they act as co-creators or co-producers of knowledge-based solutions. Since clients have a large part of the knowledge and skills necessary to successfully develop the solution they themselves need, in the co-production processes, the client’s role is emerging, multifaceted and highly collaborative (Bettencourt et al., 2012; Den Hertog, 2001; Miles et al., 1995; Strambach, 1994).

82The KIBS-client relationship is understood as follows (Muller, Doloreux, 2009): A company (client) approaches a KIBS when it has a problem but does not have all the knowledge and/or the skills needed to solve it. The two parties interact and cooperate since the problem is always customer-specific and, as a result, the solution provided by the advanced services company must necessarily be adapted to the customer’s problem. Thus, finding the solution is a fully shared process (Grandinetti, 2018).

Thanks to the close collaboration with clients, KIBS are able to offer services that are highly integrated into their client’s innovation system since they combine the development of their own knowledge with that of their clients. This ongoing dynamic creates considerable positive externalities and the possibility of accelerating the intensification of knowledge integration and knowledge synergies through the economy (Wong, He, 2005). In this way, KIBS generally obtain high levels of customer satisfaction since their services are integrated into their clients’ goods or services, which are subsequently transferred to the market. (Santos-Vijandé, 2013).

KIBS and client interaction remain the core of the scientific literature on KIBS; however, several studies have brought to light the importance of other types of collaboration with other knowledge-creation agents such as universities, other KIBS, technological centres, public institutions, competitors or suppliers (Aarikka-Stenroos, Jaakkola, 2012; Aslesen and Isaksen, 2007; Doloreux et al., 2016; Fernandez, Ferreira 2013; Freel, 2006; Grandinetti, 2011; Hakanen, 2014; Hakanen, Jaakkola, 2012; Hipp 1999; Hipp et al., 2015; Koch and Strotmann, 2008; Leiponen, 2005; Miozzo et al., 2016; Ojanen et al., 2009; Tether and Tajar, 2008; Tseng et al., 2011; Zieba et al., 2017).

KIBS play a very important role, especially in articulating the flows of knowledge that occur in the context of innovation systems (Seclen and Barrutia, 2018). Thus, collaboration with suppliers (universities, technology centers or other KIBS) as a source of learning, knowledge and innovation is a common practice for KIBS and many of them also develop their services with other organizations, including competitors, suppliers, as well as universities (Bettiol et al. 2011; Hipp, 1999; Johnston and Huggins, 2016; Koch and Strotmann, 2008).

KIBS develop complex operations in which the generation and dissemination of knowledge occur through intense interactions between the 83user and the producer and therefore, human capital plays a fundamental role (Fuglsang et al., 2011; Leo et al., 2010; Mas-Verdú et al., 2011).

The literature also argues that highly qualified human capital is central to foster knowledge intensive business services competitiveness. This is mainly due to the importance of tacit knowledge, absorptive capacity (acquisition, assimilation and exploitation of new knowledge) and the high level of personalization of the services they offer (Carmona-Lavado et al., 2013). Professionals working in KIBS companies are employees with a high educational qualification, who create and combine knowledge in an innovative way to generate competitive advantages for their clients (Den Hertog, 2000; Huggins, 2011; Miles, 2005; Miles et al., 1995).

Internal management of professionals who are KIBS staff, has also been studied through the prism of talent management. The dichotomy autonomy and control, as well as participation and a sense of belonging have been the most commonly analysed aspects of KIBS’ management (Cohen et al., 2003; Greenwood et al., 1990; Kärreman et al., 2003; Mills et al., 1983).

Unlike in many other service industries, within KIBS, structural separation between R&D and production staff usually does not exist (Tuominen and Toivonen, 2011). Knowledge intensive activities are often carried out by the same employees who carry out the usual operations of service provision (Sundbo, 1997; Sundbo and Gallouj, 1998). This type of organizational system can be seen as an “empowerment system”, where all employees can act as intrapreneurs and where management aims to stimulate and supervise these business activities (Sundbo, 1996).

2. Methodological approach

2.1 Measures

Since it is difficult to dissect the drivers of KIBS’s competitiveness in dimensions and factors, as there are multiple relationships between concepts such as innovation, co-creation, personalization, etc., an integrated model is proposed that intends to group the elements that have a higher level of integration following a certain logic, that is, by clustering 84them in dimensions. It must be noted, however, that there is a degree of interrelation amongst a number of them.

The model focuses on analysing and evaluating endogenous factors that favor better performance of KIBS. In line with the theoretical approach proposed at the beginning of this paper, the theory of dynamic capabilities (DCV), the model proposed focuses on a series of intra-organizational elements.

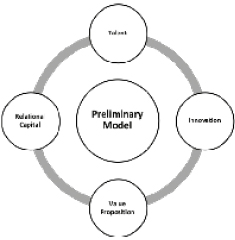

These elements are divided in four dimensions as shown in Figure 2.

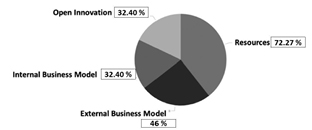

Dimension 1: Innovation

The first dimension concerns the use of resources for innovation, open innovation and other core activities regarding innovation in the internal and external parts of the business model. This dimension is composed of four factors: (i) resources allocated for innovation within the firm, innovation activities within the (ii) internal, (iii) external part of the business model1 and (iv) activities regarding open innovation.

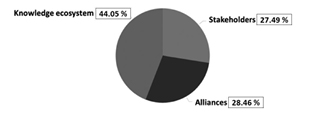

Dimension 2: Relational capital

The second dimension seeks to assess the degree to which KIBS firms have competences and capabilities for building relational capital and networks with clients and other stakeholders. It is composed of three factors: (i) collaboration with stakeholders: suppliers, universities, clients, knowledge centres, clusters and/or competitors, (ii) structured alliances with stakeholders mentioned in the previous factor and (iii) ecosystem integration, which refers to the interaction and integration within the regional knowledge ecosystem.

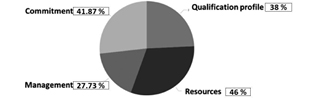

Dimension 3: Talent

Since knowledge is the most valuable asset of KIBS, staff profiles and talent management are explored in the third dimension. It is composed of four factors: (i) the educational profile or qualification of the staff within the firm, (ii) the resources allocated for training and 85improvement of the staff competencies and capabilities, (iii) the existence of management practices to develop human resources aligned with the firm’s strategy and (iv) the level of staff commitment in terms of their sense of belonging, autonomy, implication in the project as well as participation in decision making and in financial results.

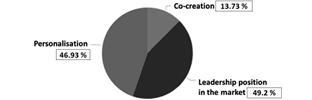

Dimension 4: Value proposition

This dimension entails KIBS’ capacity to provide an attractive value proposition to their client firms. This fourth dimension is composed of three factors: (i) co-creation, which measures the services created and delivered jointly with clients, (ii) the degree of personalisation offered to the client, percentage of standard vs. customised services, and the impact of personalised services in the client-firms’ business model (iii) the position of the KIBS in the sector relative to competitors (leader vs. follower).

Fig. 2 – Preliminary model for competitiveness assesment in KIBS.

86To rate the model as a whole, each of the dimensions is scored from 0 to 100, so that the maximum number of points possible for a subject company in terms of the whole model is 400 points.

2.2 Sample

The research is focused on the Basque Country (Spain), a region with an employment density in KIBS that is very close to the EU-15 average. In the Basque Country, 8.2 per cent (Orkestra, 2014) of the work force is employed in the KIBS sector versus 8.84 per cent as an average for EU-15 (Kamp, Ruiz de Apodaca, 2017; Orkestra, 2014).

At the request of the EU, Schnabl and Zenker (2013) proposed a classification of knowledge intensive business services that has generated a certain consensus in the scientific community, since it integrates various approaches and is consistent with the definition of KIBS. These are the epigraphs that they propose when classifying KIBS according to NACE Rev2 (Statistical classification of economic activities in the European Community):

–Programming, consulting and other activities related to computer science (NACE 62)

–Information services (NACE 63)

–Legal and accounting activities (NACE 69)

–headquarters activities; business management consulting activities (NACE 70)

–Technical architectural and engineering services; technical tests and analysis (NACE 71)

–Research and development (NACE 72)

–Advertising and market research (NACE 73)

To complete this approach, a number of authors also propose to include several activities of group 74 – “Other professional, scientific and technical activities” (Gallego and Maroto, 2015; Hipp et al., 2013; Muller and Doloreux, 2009), and even, more recently, others include the whole 74 division (Antonietti and Cainelli, 2012; Lafuente et al., 2017; Minondo, 2016).

87Although there is no absolute consensus in the scientific community, considering the definitions proposed by the main authors, the following NACErev2 codes have been selected to configure KIBS sample:

Tab. 1 – NACE rev2 codes for KIBS identification.

|

NACE rev2 |

Description |

|

62 |

Computer programming, consultancy and related activities |

|

63 |

Information service activities |

|

69 |

Legal and accounting activities |

|

70 |

head office activities; management consultancy activities |

|

71 |

Architectural and engineering activities; technical testing and analysis |

|

72 |

Scientific research and development |

|

73 |

Advertising and market research |

|

74 |

Other professional, scientific and technical activities (except: 74.2: Photographic activities and 74.3 Translation and interpretation activities) |

2.3 Procedure

The author contacted by mail approximately 1000 KIBS companies in the Basque Country, 75 of which responded positively and agreed to participate in the research. Semi-structured interviews was the method for data collection. Interviews were done with managers of these firms, each lasting 60 to 90 minutes. Interviews with managers, or elite interviews, are a method for gathering research data whose objective is to obtain first-hand information from people who have decision-making power and thus have responsibility in companies (Dexter, 1970). Due to the holistic approach of the dimensions, we considered this type of interviews the most appropriate way of conducting the research.

A set of questions where prepared related to each of the dimensions of the model, interview participants were asked to score their firm on each component of each dimension on the 1 – 100 scale.

883. Preliminary results

As stated in the introduction, this is a work-in-progress. Hence, the results are preliminary and at the moment the author is still collecting data and refining the assessment model.

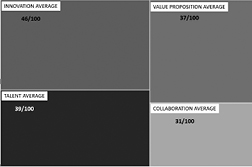

An analysis of the four dimensions in the sample shows that Innovation generates the strongest results, with an average score of 46 points out of 100. Next highest is Talent’s average score of 39 points, then Value Proposition 37 and finally, the lowest-ranked competitive dimension of the firms is Collaboration (see Figure 4, below).

Fig. 3 – Average results of the four dimensions.

Turn next to an internal examination of the dimensions. If we analyse each of the dimensions one by one, we can see, as illustrated in Figure 4: Innovation, that most of the companies interviewed are allocating resources for their internal R&D and foresight research (72.27/100). In fact, this is the highest score of all of the factors in the model.

Secondly, the external portion of business model innovation (channels, customer relationships, value proposition and new customer segments) is rated at 46 points while open innovation activities and internal business model innovation are tied for the lowest, both scoring 32.4 points.

89

Fig. 4 – Results for Dimension 1: Innovation.

Dimension 2: Relational Capital is composed of three factors. The average score for the Knowledge Ecosystem factor stands at 44.05 points, the highest of the three. Second, the factor Alliances scores substantially lower, at 28.46 points out of 100, reflecting their relatively little activity aimed at long term and stable alliances with partners. Third, the facto concerning relational capital with other stakeholders is assessed and the average for this factor is 27.49, again showing the relatively low effort invested in collaboration activities with other agents: universities, research centres, providers and competitors.

Fig. 5 – Results for Dimension 2: Relational Capital.

The third dimension of the model concerns Talent in KIBS staff. The most highly rated of the four factors composing this dimension is the resources allocated in order to improve the skills of their professionals 90(46/100), i.e. basically, training provided them in innovative knowledge acquisition. The second most highly rated factor is staff’s sense of belonging, that is, the level to which they report a shared vision and it scores 41.87 points. The qualification profile of the staff assesses their level of skills regarding the core knowledge of their business, and, surprisingly, this factor is ranked third out of four, is rated with only 38 points. The least important factor in this dimension concerns the degree to which the KIBS firm is managing its human resources in a strategic way, by offering career paths and development opportunities. Here, the average score is also low (27.73/100).

Fig. 6 – Results for Dimension 3: Talent.

Finally, Dimension 4, is the value proposition offered by the KIBS firms to their clients. Many of the firms in the sample rate positively their competitive position in the market compared to their competitors (49.20) as well as, second, the degree of service personalisation and customisation (46.93). Finally, the factor concerning the level of co-creation with customers is scored relatively very low (13.73).

Fig. 7 – Results for Dimension 4: Value proposition.

91If we have a look at the results by size of the company, we see that size is seen as a moderately important factor for KIBS competitiveness. In our research, the bigger the company is, the better is their performance in the model. On average in terms of all four dimensions, large companies obtained 41.57 points out of 100, medium-sized KIBS, 40.25 points, small 32.09 and micro-companies 33.04/100.

Nevertheless, if we have a look at the best rated companies and compare the results obtained in the model, we see that they are varied. The top 10 companies in the sample are mostly medium size companies with a highly-customer orientated strategy, co-creating in teams with their client’s staff, offering customised services and establishing long-term partnerships with them. They are also featured for having a specific budget for R&D and for being externally oriented in their business model innovation (value proposition, channels and customers). Finally, the most highly-rated companies focus on their human resources’ qualifications as a source of competitiveness: they allocate resources for continuous training and make efforts to build a culture to foster commitment within the firm.

Conclusion

The main contribution of the paper is the proposition of a model to assess Knowledge Intensive Business Services’ (KIBS’) competitiveness from an intraorganizational perspective. Unlike most of the literature related to KIBS, this paper is focused on the intrinsic characteristics of KIBS at the firm level: management practices, organizational structure, necessary resources, key activities and capacities that make some KIBS more competitive than others (Castaldi et al., 2013; Pina 2016).

We can conclude that a number of the hypotheses coming from the review of the literature are confirmed by our data. These hypotheses include resources allocated for innovation, innovating their value propositions and personalisation of service to the customer. By contrast, other factors the literature identifies as key for improving knowledge intensive business services competitiveness and performance (such as 92open innovation, the qualification profile of their staff or co-creation with the client) are clearly rated as less important in our sample.

This preliminary study, not unexpectedly, also has limitations. One of these concerns the different perceptions by the managers interviewed of the concepts they are asked to evaluate. Certain factors are subjective and respondents’ answers might have varied due to differences in their subjective understanding. The type of questions asked need to be refined in order to maximize the probability that there is a common understanding of them.

We will continue enlarging the scope of the research and at the same time make changes in the assessment tool. Next steps of our investigation will address quantitative methods to assess the relationships among the factors and also more advanced analysis method (such as Multicriteria Decision Analysis) will be used to get more robust results. Finally, we will explore to what extent the scores provided by our model are correlated with the economic and financial ratios of the KIBS taking part in the research.

93References

Antonietti R., Cainelli G. (2012), “KIBS and the city: GIS evidence from Milan”, Economia Politica, vol. XXIX, no 3, p. 305-318.

Battisti G., Gallego J., Rubalcaba L., Windrum P. (2015), “Open innovation in services: knowledge sources, intellectual property rights and internationalization”, Economics of Innovation and New Technology, vol. 24, no 3, p. 223-247.

Bettencourt L. A., Ostrom A. L., Brown S. W. & Roundtree R. I. (2002), “Client co-production in knowledge-intensive business services”, California Management Review, vol. 44, p. 100-128.

Bettiol M., Di Maria E. & Grandinetti R. (2011), “Market extension and knowledge management strategies of knowledge-intensive business services”, Knowledge Management Research & Practice, vol. 9, no 4, p. 305-314.

Carmona-Lavado A., Cuevas-Rodriguez G. & Cabello-Medina C. (2013), “Service Innovativeness and Innovation Success in Technology-based Knowledge-Intensive Business Services: An Intellectual Capital Approach”, Industry and Innovation, vol. 20, no 2, p. 133-156.

Castaldi C., Faber J. & Kishna M. J. (2013), “Co-innovation by KIBS in environmental services – A knowledge-based perspective”, International Journal of Innovation Management, vol. 17, no 5, p. 1-17.

Cohen L., Finn R., Wilkinson A., Arnold J. (2003), “Preface: Professional work and management”, International Studies of Management & Organization, vol. 32, no 2, p. 3-23.

Consoli D. & Elche-Hortelano D. (2010), “Variety in the knowledge base of Knowledge Intensive Business Services”, Research Policy, vol. 39, no 10, p. 1303-1310.

Corrocher N. & Cusmano L. (2014), “The ‘KIBS engine’ of regional innovation systems: empirical evidence from European regions”, Regional Studies, vol. 48, no 7, p. 1212-1226.

Corrocher N., Cusmano L. & Morrison A. (2008), “Modes of innovation in knowledge intensive business services evidence from Lombardy”, Journal of Evolutionary Economics, vol. 19, no 2, p. 173-196.

Den Hertog P. D. (2000), “Knowledge-intensive business services as co-producers of innovation”, International Journal of Innovation Management, vol. 4, no 4, p. 91-528.

Den Hertog P., van der Aa W. & de Jong M. W. (2010), “Capabilities for managing service innovation: towards a conceptual framework”, Journal of Service Management, vol. 21, no 4, p. 490-514.

94Dexter L. A. (1970), Elite and specialized interviewing, Northwestern University Press.

Doloreux D., Shearmur R., & Rodriguez M. (2016), “Determinants of R&D in knowledge-intensive business services firms”, Economics of Innovation and New Technology, vol. 25, no 4, p. 391-405.

Ferreira J., Raposo M. & Fernandes C. (2013), “Does innovativeness of knowledge-intensive business services differ from other industries?”, The Service Industries Journal, vol. 33, no 7-8, p. 734-748.

Fuglsang L., Sundbo J., & Sörensen F. (2011), “Dynamics of experience service innovation: Innovation as a guided activity, results from a Danish survey”, Service Industries Journal, vol. 3, no 5, p. 661-677.

Gallouj F. (2002) “Knowledge-Intensive Business Services: Processing Knowledge and Producing Innovation,” in Gadrey J. and Gallouj F. (eds) Productivity, Innovation and Knowledge in Services. New Economic and Socio-Economic Approaches, Cheltenham, Edward Elgar, p. 256-284.

Gallouj F. (2010), “Services innovation: assimilation, differentiation, inversion and integration”, in Bidgoli H. (ed.), The Handbook of Technology Management, Hoboken, NJ, John Wiley and Sons, p. 989-1000.

Gallego J. & Maroto A. (2015), “The Specialization in Knowledge-Intensive Business Services (KIBS) across Europe: Permanent Co-Localization to Debate”, Regional Studies, vol. 49, no 4, p. 644-664.

Greenwood R., Hinings C.R., Brown J. (1990), “P2-Form strategic management: Corporate practices in professional partnerships”, Academy of Management Journal, vol. 33, no 4, p. 725-755.

Hipp C. (1999), “Knowledge-intensive business services in the new mode of knowledge production”, AI & Society, vol. 13, no 2, p. 88-106.

Hipp C. (2000), “Information flows and knowledge creation in knowledge-intensive business services: Scheme for a conceptualization”, in Metcalfe J. S. & Miles I (eds), Innovation systems in the service economy: measurement and case study analysis, Boston, MA, Kluwer Academic Publishers, p. 149-167.

Hitt M., Bierman L., Uhlenbruck K. & Shimizu K. (2006), “The importance of resources in the internationalization of professional service firms: The good, the bad, and the ugly”, Academy of Management Journal, vol. 49, no 6, p. 1137-1157.

Huggins R. (2011), “The Growth of Knowledge-Intensive Business Services: Innovation, Markets and Networks”, European Planning Studies, vol. 19, no 8, p. 1459-1480.

Johnston A. & Huggins R. (2016), “Drivers of University-Industry Links: The Case of Knowledge-Intensive Business Service Firms in Rural Locations”, Regional Studies, vol. 50, no 8, 1330-1345.

95Kamp B., Ruiz de Apodaca I. (2017), “Are KIBS beneficial to international business performance: Evidence from the Basque Country”, Competitiveness Review: An International Business Journal, vol. 27, no 1, p. 80-95.

Kärreman D., Sveningsson S., Alvesson M. (2003), “The return of the machine bureaucracy? Management control in the work settings of professionals”, International Studies of management and Organization, vol. 32, no 2, p. 70-92.

Koch A. & Strotmann H. (2008), “Absorptive capacity and innovation in the knowledge intensive business service sector”, Economics of Innovation and New Technology, vol. 17, no 6, p. 511-531.

Lafuente E., Vaillant Y. & Vendrell-Herrero F. (2017), “Territorial servitization: Exploring the virtuous circle connecting knowledge-intensive services and new manufacturing businesses”, International Journal of Production Economics, vol. 192, p. 19-28.

Leo P., Philippe J., & Monnoyer M. C. (2010), “Services and high skills: A new challenge for developing medium-sized cities”, Service Industries Journal, vol. 30, no 4, p. 513-529.

Merrilees B., Rundle-Thiele S. & Lye A. (2011), “Marketing capabilities: antecedents and implications forB2B SME performance”, Industrial Marketing Management, vol. 40, no 3, p. 368-375.

Miles I., Kastrinos N., Flanagan K., Bilderbeek R., Hertog P.D., Huntink W., Bouman M. (1995), Knowledge-intensive business services. Users, carriers and sources of innovation, Report to DG13 SPRINT-EIMS, March.

Mills P., Hall J., Leidecker J., Margulies N. (1983), “Flexiform: A model for professional service organizations”, Academy of Management Review, vol. 8, no 1, p. 118-131.

Minondo Uribe-Etxeberria A. (2016), “Exporters of knowledge-intensive business services in Basque Country”, Ekonomiaz, vol. 90, no 2, p. 318-335.

Muller E., & Zenker A. (2001), “Business services as actors of knowledge transformation: The role of KIBS in regional and national innovation systems”, Research Policy, vol. 30, no 9, p. 1501-1516.

Muller E., Doloreux D., (2009), “What we should know about knowledge-intensive business services”, Technology in Society, vol. 31, no 1, p. 64-72.

Osterwalder A., Pigneur Y. (2010), Business Model Generation: A Handbook For Visionaries, Game Changers, And Challengers, Hoboken, New Jersey, John Wiley and Sons.

Pina K., & Tether B. S. (2016), “Towards understanding variety in knowledge intensive business services by distinguishing their knowledge bases”, Research Policy, vol. 45, no 2, p. 401-413.

Reid M. (2008), “Contemporary marketing in professional services”, Journal of Services Marketing, vol. 22, no 5, p. 374-384.

96Santos-Vijande M.L., González-Mieres C. & López-Sánchez J.A. (2013), “An assessment of innovativeness in KIBS: implications on KIBS’ cocreation culture, innovation capability, and performance”, Journal of Business & Industrial Marketing, vol. 28, no 2, p. 86-102.

Seclen Luna J.P., Barrutia Guenaga J. (2018), “KIBS and innovation in machine tool manufacturers. Evidence from the Basque Country”, International Journal of Business Environment, vol. 10, no 2, p. 95-11.

Tether B. S. & Tajar A. (2008), “Beyond industry-university links: Sourcing knowledge for innovation from consultants, private research organisations and the public science-base”, Research Policy, vol. 37, no 6, p. 1079-1095.

Tuominen T., Toivonen M. (2011), “Studying Innovation and Change Activities in KIBS through the Lens of Innovative Behaviour”, International Journal of Innovation Management, vol. 15, no 2, p. 393-422.

Wei J., Yan T., Jiangqi Z. (2008), “Barriers to service innovation: Empirical study on Chinese KIBS from Yangtze Delta. In Proceedings of the 4th IEEE International Conference on Management of Innovation and Technology”, September, IEEE, p. 1506-1510.

Zieba M., Bolisani E., Scarso E. (2016), “Emergent approach to knowledge management by small companies: mutiple case-study research”, Journal of Knowledge Management, vol. 20, no 2, p. 297-307.

1 The division of the internal and external activities of the business model follows the Busines Model canvas proposed by Osterwalder and Pigneur (2010).