Évaluer la relation entre les services de TIC et l'industrie manufacturière dans une perspective méso-économique Le cas du Pays Basque

- Type de publication : Article de revue

- Revue : European Review of Service Economics and Management Revue européenne d’économie et management des services

2018 – 2, n° 6. varia - Auteurs : Kamp (Bart), Sisti (Eduardo)

- Résumé : Cet article examine dans quelle mesure le développement de l'internationalisation d'un sous-secteur régional de services de TIC peut s'expliquer par le développement des activités manufacturières de la même région. L’étude aboutit à une réponse mitigée à cette question, sur la base d’analyses quantitatives, dans le Pays Basque. Au total, ces résultats apportent un nouvel éclairage sur le débat en cours quant à l'importance des services aux entreprises intensifs en connaissances dans le développement industriel.

- Pages : 123 à 151

- Revue : Revue Européenne d’Économie et Management des Services

- Thème CLIL : 3306 -- SCIENCES ÉCONOMIQUES -- Économie de la mondialisation et du développement

- EAN : 9782406086338

- ISBN : 978-2-406-08633-8

- ISSN : 2555-0284

- DOI : 10.15122/isbn.978-2-406-08633-8.p.0123

- Éditeur : Classiques Garnier

- Mise en ligne : 15/10/2018

- Périodicité : Semestrielle

- Langue : Anglais

- Mots-clés : Services aux entreprises intensifs en connaissances, services de technologie de l'information et de la communication, internationalisation, développement sectoriel, tableaux entrées-sorties, spécialisation régionale

Assessing the relationship

between ICT services

and the manufacturing

industry from a meso-

economic perspective

Insights from the Basque Country1

Bart Kamp2,

Eduardo Sisti

Orkestra–Instituto Vasco

de Competitividad

& Deusto University

Introduction

In this paper we examine the relationship between the KIBS sub-sector of ICT services and the manufacturing industry in the Basque Country. The base rationale for this is that KIBS and ICT services are considered highly important to the competitiveness of manufacturing activities.

Moreover, particularly at a time when concepts like Industry 4.0 are entering the manufacturing world, we may assume that manufacturing processes are becoming increasingly knowledge-intensive. Hence, we may expect to see a strengthening of the relationship between ICT services and manufacturing sectors.

124Based on datasets that cover a time span of over a decade, we can observe certain patterns of co-evolution between the Basque manufacturing and ICT services sectors, although we do not discern synergies between the two as regards the development of international business. While the manufacturing industry is expanding its international footprint, ICT services activities operate chiefly in the domestic market.

Although the analyses conducted reveal the existence of (partial) synergies between the ICT services sector and the manufacturing industry in the Basque Country, it also becomes clear that rather than the manufacturing industry, it is the tertiary (services) sector that acts as the most important recipient of the output of the ICT services sector. However, this sector also appears unable to channel the ICT services sector’s international business potential. To explain and remedy these situations, this paper concludes with a number of implications and recommendations.

The rest of the paper is structured as follows. Section 1 presents a literature review to set the scene. Section 2 presents the research methods and techniques as well as the datasets we utilized. Section 3 presents the results of our research and section 4 analyzes and discusses these findings further. Section 5 presents implications from our investigation and section 6 concludes the paper with suggestions for further research and limitations to the present work.

1. Theoretical background

Knowledge-Intensive Business Services (KIBS) are considered important inputs for the vitality and competitiveness of companies and sectors that consume such services. Particularly for manufacturing activities, they are believed to be essential for moving up the added-value ladder and preventing footlooseness (Dachs, 2010; Gotsch et al., 2011; IDEA, 2013).

Over time, it has been demonstrated that industrial firms rely increasingly on external providers of KIBS, such as research companies, IT firms and engineering organizations, as well as legal and marketing 125firms (Dachs et al., 2012). Evangelista et al. (2013) set out to investigate the extent to which external business services – as inputs to user sectors – support the economic performance of the latter. They conclude that business services indeed exert a positive impact on the economic performance of user industries, thus backing up earlier findings by Baker (2007), Camacho and Rodriguez (2007), and Kox and Rubalcaba (2007). In a similar vein, Dachs (2010) and Gotsch et al. (2011) underline the importance of KIBS for improving the value propositions that industrial firms launch to market.

Similarly (or as a consequence), policy makers have shown an increased interest in KIBS as a means of stimulating the regional manufacturing base (Jensen et al., 2007; European Commission, 2012; Corrocher and Cusmano, 2014) and complying with (or exceeding) the EU objective of generating 20 % of gross value added from industrial activities (European Commission, 2014).

The importance of KIBS for business performance at a territorial level has been stressed by Tödtling et al. (2009) and Kamp and Bevis (2012), among others. They assert that a substantial number of private firms find working with KIBS – compared to scientific knowledge centres – advantageous, because of their superior responsiveness and familiarity with the culture of private firms, their ability to think along the same lines as private businesses in terms of market applications and product and process design, and their ability to work with short-term assignments. Additionally, Cooke and Memedovic (2003) argue that as regional economies develop, the demand for knowledge inputs becomes more sophisticated and the role of specialized private providers of such services becomes more prominent. Similarly, Antonelli (1998) and Jensen, Johnson, Lorenz and Lundvall (2007) contend that the competitiveness of firms has come to depend highly on their use of KIBS, and that the competitiveness of regional economic complexes also relates to their KIBS capabilities. Dachs (2010), Gotsch et al. (2011) and Brenner et al. (2017) also assert that the presence of a diversified KIBS sector with critical mass in a locality often serves as an important indicator of the overall competitiveness of its economy. Finally, scholars that adhere to industrial network theories underscore the need to pay greater attention to KIBS and their contribution – through B2B interactions – to (manufacturing) industry performance, as voiced by Henneberg, Gruber 126and Naudé (2013) and Ostrom et al. (2010). Consequently, Corrocher and Cusmano (2014) refer to KIBS as ‘vitamins’ for manufacturing competitiveness, particularly for those industrial firms that depend strongly on the knowledge content provided by specialized suppliers from the sphere of KIBS.

A vast body of research indicates that locally available KIBS providers offer advantages to industrial customers (particularly SMEs) over geographically distant suppliers of KIBS (Müller and Zenker, 2001; Miles, 2003; Strambach, 2008; Dachs, 2010; Gotsch et al., 2011; Savic, 2016). François and Hoekman (2010) refer to the so-called proximity burden in this regard. Additionally, works by Jensen et al. (2007) and Feser and Proeger (2015) describe KIBS as credence goods, meaning that they are characterized by a substantial degree of tacitness. This means that close interactions and high encounter situations favour the outcome of KIB servicing and that proximity between buyer and supplier matters (Martinez-Arguelles and Rubiera-Morollon, 2006; Koch and Strotmann, 2008).

In line with the preceding, we find studies that observe how highly specialized KIBS activities emerge or cluster in places where equally specialized industrial activities exist (see, e.g., Shearmur and Doloreux, 2008; Jacobs et al., 2016; or more general studies from the field of regional smart specialization, such as Rodríguez and Camacho, 2016). This means that while ‘horizontal’ KIBS branches (like management consulting, marketing services and engineering activities) can emerge anywhere, ‘vertical’ KIBS structures (geared towards specific sectors, such as chemicals, automobiles or machine tools) tend to emerge in places where there are specialized demand conditions (Porter, 1990; Thomi and Böhn, 2003, 2008; Gotsch et al., 2011; Rodríguez and Camacho, 2016). As Strambach (2008, p. 162) argues, this follows from the fact that ‘over time, firms develop competencies that are highly sector- and technology-specific and they also develop competencies which are related to the specific features of users and demand.’ Consequently, that is how sector-specific or vertically specialized KIBS structures can emerge (Guerreri and Meliciani, 2003; Picard and Rodet-Kroichvili, 2012), and how ‘regional exports growth can be accelerated if regions specialize in KIBS’ (Minondo, 2016, p. 322).

Curiously, the above may not lead to a situation where every territory with a specialized industrial structure will also develop a correspondingly specialized KIBS support structure. In fact, between regions with a similar 127industrial demand structure, a kind of tiered or hierarchical system may emerge, whereby one region becomes the primus inter pares when it comes to specialized KIBS supply. This follows on from the observation that while overall, services do not travel that well, highly specialized KIBS travel a lot better (Minondo, 2016). Consequently, providing specialized KIBS may not need that much constant proximity and such services may require a broader user base than just local demand to be sustainable (Rodriguez-Pose and Crescenzi, 2008; Gallego and Maroto, 2013). Additionally, proximity may in fact matter more for operational (horizontal) services than for advanced (vertical) services (Picard and Rodet-Kroichvili, 2012).

Among the different KIBS that exist, information and communications technology (ICT) services are considered particularly important for upgrading production processes and manufacturing value propositions (Brettel et al., 2014). In fact, within the realm of digital transformation, ICT services are seen as vital for the competitiveness of industrial firms and for rolling out smart products and processes (Ollo-López and Aramendía-Muneta, 2012). In fact, as manufacturing firms increasingly embrace Industry 4.0 principles, where all kinds of new technological hardware, software and services have a substantial impact in terms of competitiveness, information and communications technology is set to play a significant role (Brettel, Friederichsen, Keller and Rosenberg, 2014). Accordingly, ICT inputs make it possible to create smart production operations, products and services, which can be offered as digitally engineered product–service systems (Kowalkowski et al., 2013; Acatech, 2015). In addition, Guerreri and Meliciani (2003) found that manufacturing consumption of ICT generally has a positive impact on the export of ICT-intensive services to producers. Also, François, Machin and Tomberger (2015) point to piggy-backing effects between manufacturing exports and information-intensive services. They reveal how services represent a large component of the added value embodied in manufacturing exports and that indirect exports (via sales to local manufacturing clients) are very important to total service exports, especially for KIBS.

As regards the supply of ICT services, Nepelski and De Prato (2014) point out that proximity considerations are regarded as important for generating competitiveness on the (industrial) user side. In line with the idea that vertical specialization evolves in places where a concentration of specialized demand for advanced manufacturing solutions is present, it is 128then likely that a corresponding range of ICT services capabilities takes shape in regions with a specialized manufacturing profile (although not all industrially advanced regions may see this happen to the same extent).

Altogether, the preceding provides further justification for exploring whether there is a relationship between ICT services consumption by industry and corresponding developments in terms of the size and performance of the buyer and supplier sides in such a relationship. Against this backdrop, we set out to examine whether these premises hold true at a meso-economic level. In other words, can common development patterns be discerned between a regional ICT services sector and the manufacturing industry in the same territory?

2. Data and methodology

The empirical research setting from which we draw the data to examine our research question is the Basque Country. We posit that it provides a relevant test setting since the Basque economy has an above-average reliance on industrial activities, with industry accounting for a higher share of gross value added in comparison with Spain and the EU (Kamp and Alcalde, 2014; Kamp and Ruiz de Apodaca, 2017). In fact, this region is a traditional industrial heartland of the Iberian Peninsula, and although it underwent significant industrial conversions in recent decades (notably in the 1990s), it has shown ongoing political commitment to maintaining industry at the centre of the regional economy (Konstantynova, 2017). At present, around a quarter of the Basque economy’s gross value added comes from the secondary sector, with metalworking, machine tool building and transport material accounting for more than half of that.

As such, it has a particular interest in keeping that part of the economy in good shape. According to the scholars mentioned earlier (e.g. Dachs, 2010; Gotsch et al., 2011; Dachs et al., 2012), among other things, this means making proper use of inputs from KIBS and ICT agents, ideally from the same (regional) home base. This is an argument that is also followed and examined by Borowik (2012), who takes a longitudinal view of the role of KIBS in the Basque Country vis-à-vis 129the ups and downs of its industrial base. As regards the presence and state of ICT activities in the Basque Country, Valdaliso et al. (2012, p. 176) provide a broad-based analysis and conclude that the Basque ICT cluster is characterized by ‘sticky factor conditions, qualified demand, an entrepreneurial technological regime, and quite high related variety’.

Given the research questions we formulated at the end of section 1, we set out to conduct exercises to help examine whether the presence and consumption of intra-regional ICT services are indicative of the way that manufacturing sectors develop over time (and vice versa), and whether their respective trends follow common patterns or even reveal correlations. Therefore, to examine to what extent ICT services play a role in invigorating and providing resilience to manufacturing activities, we first of all determined to carry out a longitudinal analysis of the size (in terms of gross value added and employment) of the ICT services sub-sector in the Basque Country and then compare this with data from other territories in Europe, i.e. to put the development and size of the Basque ICT services business into a comparative perspective. Secondly, we wanted to focus on analysing trends in the Basque manufacturing industry and its use of ICT services. For this we decided to use input–output tables, which make it possible to reconstruct the uptake of ICT services by manufacturing sectors for a series of years. On that basis, we felt that this should allow us to compare ICT services ‘consumption’ by these sectors with their development in terms of turnover and exports, to see whether or not the respective trends converge. Thirdly, we considered the trend in general sales in ICT services sector geographical destinations (domestic/regional, national and foreign sales). That is, we looked at what the main geographical markets for Basque ICT services are and how sales have developed in the different geographical areas. Fourthly, we decided to look at the sectoral destinations of Basque ICT services and to what extent they find their way into the industrial part of the economy or into the tertiary (service) sector. We felt that this would provide insights into the relative importance of demand for the Basque ICT services sub-sector from the domestic secondary and tertiary sectors, and how demand from both sectoral destinations has varied.

In order to conduct our analyses, we were required to consult different sources and triangulate different datasets. This forced us to be critical in picking subsets of data since different sources use different classification schemes, and sometimes they even vary over time (even 130when utilizing the same source). We proceeded in the following manner to ensure maximum alignment between the different subsets:

The data that we processed came from three different sources: the Basque Statistical Institute (Eustat), Spain’s National Statistics Institute (INE) and the European organization Eurostat.

The Eustat data came in three forms. Firstly, they were taken from annual publications issued on the ICT sector (‘El sector de las tecnologías de la información y comunicación-TIC’). These annual reports delineate ICT services on the basis of the NACE 2009 nomenclature, in conformity with the OECD interpretation, which consists of a selection of sub-sectors 46, 58, 61, 62, 63 and 953. This made up the input for Table 1. Secondly, they came in the form of databases. A first Eustat dataset that we used was Industrial and Foreign Trade statistics4. When using these sources, we focused on the NACE 2009 sub-sectors with codes J 62 and 63 for the ICT services sector5 and codes 5–41 according to the A86 classification for the manufacturing industry6. In addition, we used Eustat Input–Output tables7. In these, the ICT services sector is represented by the sub-sector with code 81 (2000–2009) and 77 (from 2010 onwards), whereas the manufacturing sector is covered by codes 5–41 according to the A86 classification. The aforementioned sets of Eustat data were used, in different combinations, to produce figures 2–6.

INE data were used to determine gross value added figures for the manufacturing sector (as the focal consumer of ICT services for this paper’s analyses). The delineation of the manufacturing sector based on INE data consists of the NACE 2009 sub-sectors with codes C 10–338. This provided input for Figure 1.

Eurostat data with regard to the ICT services sector came in the form of the NACE 2009 sub-sectors with codes J 62 and 639. This made up the input for Table 2.

131Overall, the Eustat reports on the ICT sector are probably the most problematic for our analyses, since the range of ICT services (and industrial ICT activities) they include is considerably broader than the ‘information and computer services’ category that the other sources and datasets utilize. Consequently, the insights from Table 1 (which makes use of the aforementioned reports) are relatively minimal and only serve to provide a bigger picture.

3. Results

3.1 Gross value added

and employment indicators

As our starting point, we take data on the size of the Basque ICT sector, broken down into an industrial ICT part and a service ICT part, as reported by the Basque Statistical Institute (Eustat) in its annual publications on the ICT sector. Note that, as stated earlier, these annual reports include a range of ICT services that is broader than the ‘information and computer services’ category that forms the focal point of analysis throughout the rest of this paper.

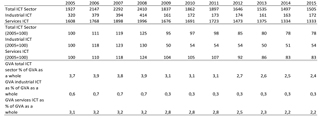

Tab. 1 – Variation in gross value added indicators for the Basque ICT sector.

Source: Eustat ‘El sector de las tecnologías de la información

y comunicación-TIC’ reports.

What we see is that until 2008 the ICT sector showed growth, and that afterwards it began to decline steadily. By the end of the time span (2015), gross value added (GVA) indicators had fallen far below those of the initial reference year (= 2005).

The drop in GVA was most severe in the manufacturing segment of the ICT sector (‘Industrial ICT’), whereas the ICT services segment performed better. Still, for both it appears that in absolute terms and in relative weight, they have fallen behind the overall GVA of the Basque economy.

As an initial way to assess how the ICT services sub-sector developed in comparison with the Basque manufacturing industry and whether their paths are intertwined, we look at the trend in GVA indicators for the Basque manufacturing industry.

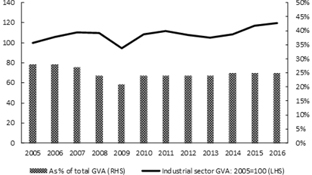

Fig. 1 – Variation in gross value added indicators

for the Basque manufacturing industry10.

Source: Prepared by the authors based on INE.

The above figure clearly shows that the manufacturing industry remained rather robust over the past decade, which contrasts with the trend in the ICT services sub-sector, as shown in Table 1. In absolute terms, it had net growth between 2005 and 2016, whereas the ICT services sub-sector saw a net decline in its GVA generation. In relative 133terms, expressed as contribution to the total GVA of the Basque economy, both the manufacturing industry and the ICT services sub-sector shrank. However, the decline of the ICT services sub-sector was substantially bigger.

Hence, on comparing the data from Table 1 and Figure 1, we find no clear signs of co-evolution between the manufacturing industry and the ICT services sub-sector. When looking at a more detailed level, particularly from 2012 onwards, there appears to be a decoupling between the trend followed by the manufacturing industry and that of the ICT services sub-sector.

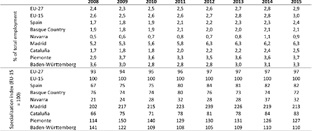

As a further way to put the size of the ICT services sub-sector in the Basque Country into perspective, we calculated two specialization indicators with regard to the Basque ICT services sub-sector for a series of years, and compare them with those from other territories. The other territories of a regional nature are regions that, like the Basque Country, also have an above-average industrial component in their economy11. Furthermore, we compare the Basque indicators with values for the national (Spanish) situation and for two supranational levels, namely the EU-15 and the EU-27.

The indicator calculations are based on employment figures in computer programming and IT services from Eurostat computer programming and IT services (NACE 2009 sub-sectors with codes J 62 and 63).

Tab. 2 – Percentage share and specialization indicators

for employment in ICT services.

Source: Prepared by the authors based on Eurostat.

134Except for Baden-Württemberg, all the other territories show a more favourable trend in their ICT services sub-sector than the Basque Country. It therefore seems that the Basque ICT services sub-sector is losing ground. This becomes particularly clear from an intra-Spanish perspective: all three of the other autonomous communities included here displayed a more positive trend than the Basque Country. And while the Madrid region is a capital area that may benefit from scale, headquarters and capital effects (AMCER, 2012), thus explaining the high and improving values for this region, this is not the case for Navarre (Navarra) and Catalonia (Cataluña), regions that made more progress than the Basque Country with regard to the selected indicators. Additionally, when comparing the Basque values with those of Spain as a whole, the trend has been less buoyant: whereas in 2008 the Basque indicators were higher than those for Spain, over time this situation was reversed.

When we compare the Basque values with those of the EU-15 and EU-27 supranational groups, we also find that the Basque ICT services sub-sector again fell behind. Altogether, it seems that employment in the ICT services sub-sector is ’under-sized’ in the Basque Country and that overall, the trend is rather lacklustre.

3.2 Consumption of ICT services

by the manufacturing industry

We will now focus on the manufacturing industry and its consumption of local ICT services over time.

Figure 2 shows how the manufacturing industry performed in terms of variation in turnover12, on the one hand, and consumption of Basque ICT services13, on the other.

135

Fig. 2 – Variation in turnover for Basque industry

and consumption of local ICT services14.

Source: Prepared by the authors based on Eustat Industrial Statistics and Input–Output tables.

From 2005 to 2009, we can observe a rather strong fit between manufacturing industry turnover and its use of ICT services. Before that period, consumption of ICT services by the manufacturing sector seemed to run somewhat parallel to the trend in turnover for the manufacturing industry, albeit hovering at a higher level. Indeed, when local ICT services consumption by the Basque manufacturing industry is divided by turnover levels for that same manufacturing industry, the ratio is higher for 2000–2004 than it is for 2005–2009. This method of calculation thus also demonstrates the decline in the uptake of ICT services by the Basque manufacturing industry.

For the 2010–2015 period, we first see a relatively good fit in 2010–2014 – although weaker than in the years 2005–2009 – before a sudden drop comes in 2015 and the link between manufacturing industry turnover and its consumption of ICT services is severed. Additionally, in terms of the ratio between local ICT services consumption by the Basque manufacturing industry, we see that this held steady between 2010 and 2014 before dropping sharply in 2015.

Moreover, throughout the time span considered, manufacturing industry expenditure on local ICT services fluctuated between 0.05 % and 0.21 %. This small fraction indicates that the manufacturing industry is not really a big spender on ICT services15.

136

Fig. 3 – Variation in Basque industrial exports and local ICT services consumption16.

Source: Prepared by the authors based on Eustat Foreign Trade statistics ECOMEX and Input–Output tables.

As regards the trend in manufacturing exports17 and ICT consumption, the picture is somewhat comparable. Firstly, we can see a certain fit between the trend in both indicators, except for the last year. Secondly, it seems that the ratio between expenditure on local ICT services by the manufacturing industry and the export value of manufactured goods is only marginal, ranging from 0.2 % to 0.5 % throughout the time span under consideration18. The latter situation points to a rather insubstantial intersection between the ICT services supply and manufacturing demand sides. Hence, it does not present the manufacturing industry as a strong pull factor or stimulus for the local ICT services sub-sector.

3.3 Geographical destinations of ICT services

consumed by the manufacturing industry

A further way to assess whether there are (strong) links between the ICT services sub-sector and the Basque manufacturing industry is by breaking down the origin of Basque ICT services turnover on a 137geographical basis: dividing the overall sales value into local (Basque), national (Spanish) and foreign (across the national border) business.

The following figure provides insights into this aspect19.

Fig. 4 – Geographical destinations of Basque ICT services output (%).

Source: Prepared by the authors based on Eustat data.

Figure 4 shows that in relative terms, the value of sales deriving from local (Basque) demand and from the rest of Spain greatly outperforms sales to foreign destinations. Clearly, the fact that there has been a change in the accounting system is problematic in that it produces a disruption in the average share of Basque ICT services represented by local demand (between 2009 and 2010, it appears to have jumped from the 60 % level to 80 %). The same is essentially true for the Spanish share of overall demand. Towards the end of the time span considered, the Basque Country in particular loses some ground as a sales destination for ICT services of Basque origin.

When looking at the importance of foreign demand for Basque ICT services, we see that it remained constant across the two sub-periods and that it only represented a minor share of total demand for these services. Having said that, in the last year studied (2015), there was an increase from the previous 2–3 % level to a larger 7 % share of the total.

138If we look at the sales figures for the respective destinations in absolute terms (Figure 5)20, we indeed see that Basque ICT services sales in the two main markets (the Basque Country and the rest of Spain) have stagnated or even gone down since 2010, whereas demand from foreign markets (the European Union and the rest of the world) remained steady or went up during the most recent years considered in our analysis.

Interestingly, while during the years 2010–2014, sales to all destinations showed the same pattern of consolidation, in 2015, domestic (Basque and Spanish) and foreign (EU and rest of world) demand moved in opposite directions: downward for domestic sales and upward for foreign sales. Obviously, since this observation is for a single year, it is impossible to infer conclusions from this. However, while the Basque ICT services sub-sector has been very reliant on local demand and appears to have had trouble gaining ground abroad, the data for the last year may point to a possible improvement in the foreign foothold of Basque ICT services.

Fig. 5 – Geographical destinations of Basque ICT

services output (in thousand euros)21.

Source: Prepared by the authors based on Eustat data.

1393.4 Sectoral demand for ICT services

The last exercise we present attempts to analyse the sectoral destinations of Basque ICT services, distinguishing between demand from the local manufacturing industry and from the local service sector22. Again, we utilize data from the Eustat Input–Output tables to generate the following figures23.

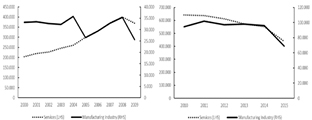

Fig. 6 – Use of Basque ICT services by the local industrial

and service sectors (in thousand euros)24.

Source: Prepared by the authors based on Eustat (Input-Output tables).

From the above charts, it becomes clear that the main ‘customer’ for Basque ICT services is the tertiary sector. In absolute terms, demand from the tertiary sector was around six to seven times the volume of demand from the industrial sector during the 2010–2014 time period. Previously (2005–2009), it had been more than ten times the size of demand from the industrial sector. Therefore, in terms of sheer magnitude, the tertiary sector is much more important for the Basque ICT services sub-sector than the industrial sector is.

In addition, if we take into account the turnover generated by the Basque tertiary sector and relate this to its expenditure on local ICT services, we find that it outpaced the industrial sector (see p. 8) in this 140ratio by a factor of two to three between 2010 and 2015. Hence, the tertiary sector displays more intense use of ICT services than does the industrial sector.

4. Discussion of findings

Our analyses show that trends in the Basque ICT services sub-sector bear some relationship to the performance of the local manufacturing sector in terms of turnover – and to a lesser extent, exports. It does not seem, however, that this relationship acts as a catalyst for the (international) growth of the Basque ICT services sub-sector.

To start with, the ratio of ‘expenditure on ICT services’ to ‘sectoral turnover of the manufacturing industry’ is too low for us to expect any sort of essential link between the two areas. This also helps to explain why the positive trend in the manufacturing industry (in terms of GVA – see Figure 1) does not translate into a similar path for the ICT services sub-sector (see Table 1). Similarly, it makes it possible to explain why turnover and export figures for the manufacturing industry (see figures 2 and 3) are not mirrored by those for the ICT services sub-sector (see figures 4 and 5, as well as Table 1).

When we bring the tertiary sector into these comparisons, we can even see how – in terms of ‘rate of ICT services consumption’ and ‘absolute expenditure value’– the tertiary sector is of substantially greater importance than the manufacturing industry to the Basque ICT services sub-sector, which is confirmed by Zubillaga (2018 a). Firstly, this limits the expectation that size-wise, the Basque ICT services sub-sector could be ‘driven’ primarily by trends in the manufacturing industry. Secondly, it calls the idea of a critical mass of Basque ICT services activities geared towards manufacturing ‘matters’ into question, and hence the rise of a specialization in vertical ICT services vis-à-vis the manufacturing industry25.

Overall, the fact that both the manufacturing industry and the tertiary sector spend a relatively small portion of their turnover on ICT services 141provides an explanation for the Basque Country’s low scores for specialization indicators, as shown in Table 2. The picture that these indicators paint is in line with European Cluster Observatory findings regarding territorial specialization indices for digital industries26. These indicators present the Basque ICT services sub-sector as generally limited in size. This has been corroborated by Zubillaga (2018b, p. 38), who calculated that the percentage of persons employed as skilled ICT professionals in the Basque Country is clearly below the EU-27 average. In combination with the other findings, these figures also fuel the idea that it is unlikely that the Basque ICT services sub-sector contains an extensive and vertical fabric of ICT services activities targeting the manufacturing industry.

On a whole then, we may have to look beyond the supply–demand relationship with the manufacturing industry to determine how the Basque ICT services sub-sector has developed. As the tertiary sector accounts for the majority of ICT services sales (six to seven times the amount of sales to the manufacturing industry), the decline in demand for ICT services from that sector is more likely to explain trends in the Basque ICT services sector in recent years, a fact that is corroborated by Zubillaga (2018a).

The reasons behind the shrinking demand for Basque ICT service inputs from the tertiary sector may be varied, and our data analyses do not reveal them. But to offer a conjecture, we could point to centralization processes of responsibilities within service sectors, which draw operations away from regional bases. Particularly in the banking sector, headquarters and capital city-centric dynamics have been making an appearance since the outbreak of the financial crisis, and this may weaken the position of regional ICT operators27.

In addition, we might also consider the replacement of local ICT services supply by imports from abroad. Our own data, however, show that the purchasing of ICT services from foreign sources by the Basque manufacturing industry and the tertiary sector is only a marginal business. Moreover, data from Zubillaga (2018a) also refute this thesis by showing that ICT services imports represent a very small amount 142of money. So even if they are on the rise (see our data for the year 2015 in Figure 5), they only represent a fraction of the total consumption of ICT services in the Basque marketplace. Therefore, we can state that there is no geographical ‘crowding-out’ process taking place in which local sourcing is replaced by purchasing from foreign suppliers.

Additionally, as regards linkages with foreign markets: whereas Basque manufacturing exports have grown consistently in recent years, foreign trade by the ICT services sector has not managed to achieve the same performance. This also supports the idea that industry has not functioned as it could as a gateway for ICT services exports. Several possible explanations can be offered. One conjecture would be that the Basque industrial sector may be selling more goods abroad than integrated product–service systems (Kamp and Sisti, 2017). If this is the case, it means that it becomes less easy for actors from the ICT services sub-sector, for example, to surf the manufacturing export wave, as it does not unlock a corresponding demand for goods-related services and intangibles. A complementary conjecture in this regard is that since KIBS and services are less export-prone than manufactured goods (Freiling et al., 2012; Minondo, 2016), domestic industrial sales may be more service-intensive or may be more geared towards product–service systems than industrial exports. This would also help to explain why the manufacturing industry’s domestic sales show a stronger fit with its ICT consumption than do exports.

Furthermore, based on the modest specialization index scores of the Basque ICT services sub-sector, it can be hypothesized that ICT services activities in the Basque Country may be chiefly ‘horizontal’ in nature, thus also having a negative impact on their export potential. In other words, the fact that the specialization index of the Basque ICT sub-sector is rather modest may indicate that it contains a thicker layer of horizontal service providers and a thinner layer of vertical service providers (see also Navarro, 2010; Kamp and Alcalde, 2014, p. 366, 369). This would help to explain why the export ratio of the Basque ICT services sub-sector is rather limited, as it is precisely highly specialized services that travel better (Minondo, 2016).

If this preponderance of ‘horizontal’ ICT services activities rather than ‘vertically specialized’ ICT services activities within the Basque ICT services sub-sector is indeed the case, it may further explain 143the relatively small size of the Basque ICT services sub-sector and its stagnant growth. For the less specialized services are, the more easily they can be replaced either by in-house provisioning (limiting sales in the local market) or by providers from elsewhere (limiting sales abroad).

As there are few imports of ICT services, and we thus do not observe crowding-out or replacement effects, we are inclined to postulate that a considerable share of the ICT services that the manufacturing industry consumes are endogenous and come in the form of internally produced Knowledge-Intensive Service Activities. As such, we believe that part of the reason for the small size of the ICT services sector in the Basque Country (see e.g. Table 1), and for the lack of synchronization with the trend in the manufacturing industry (and tertiary sector), must have to do with a reticence to turn to external parties for specialized services.

While the Basque Country could provide the basis for the development of a more sizeable and specialized ICT services sector, at present it appears that this potential is not being exploited. An attitude of holding back with regard to outsourcing specialized ICT services may be one of the reasons behind this, which also explains why imports of such services are very limited. As such, Basque industry also does not purchase much from territories where local specialization has indeed resulted in an ICT services sector with critical mass and an advanced state of specialization.

A final significant factor in this regard may be the state of digitalization in the Basque manufacturing industry. The results of a recent DESI (Digital Economy and Society Indicator) assessment for the Basque Country (Zubillaga, 2018b) found that the Basque Country is ahead of the pack in comparison to EU Member States and regions as a whole. Hence, we assume that Basque industry is not underdeveloped in terms of ICT services activities, but that the Basque situation may be more characterized by in-house development and supply of such services by the manufacturing industry itself, instead of having given rise to the creation of a buoyant and specialized ICT services support sub-sector.

1445. Theoretical, political

and managerial implications

In terms of theoretical implications, our research does not really provide evidence that a comparatively strong and healthy manufacturing industry gives rise to the creation of a vibrant ICT services sector in situ, as claimed by many scholars (see e.g. Dachs, 2010 or Nepelski and De Prato, 2014). In addition, looking at the scale of business between the ICT services sub-sector and the manufacturing industry in the Basque Country, it is not clear that this provides a case for arguing that ICT services are crucial for the (international) competitiveness of industry (cf. Brettel et al., 2014 or Guerrieri and Meliciani, 2003). This may be the case, but in the setting that we investigated, it may be more or equally true for internally developed ICT services than for externally purchased ones. We can also infer this from the fact that the absence of a strong local ICT services fabric has not led the sizeable Basque manufacturing industry to engage in intensive ICT services purchasing from other areas, as highlighted by Gallego and Maroto (2013). As such, the importance of ICT services for manufacturing competitiveness is not being questioned, but its place of origin might on occasion be embedded or endogenous rather than coming from external providers. If that is the case, it may prevent the rise of a vertically specialized ICT support sub-sector (Picard and Rodet-Kroichvilli, 2012), which appears to be the case in our research setting.

In terms of managerial implications and implications for policy makers, our research allows us to make the following assertions:

On the basis of the various analyses conducted in preparing the present paper, we can argue that there should be room in the Basque Country for a larger ICT services sub-sector. We come to this conclusion because its growth path lags behind that of all the other meso- and macro-economic trends considered (presence and development of the ICT sub-sector in other territories, trends in total GVA for the Basque Country, and trends in sectoral turnover and exports for the secondary and tertiary sectors in the Basque Country).

145Such growth may, among other things, require strengthening the outsourcing and partnering culture on the demand side, in line with the thought that service and industry or product and service are becoming increasingly difficult to disentangle (see e.g. Gallouj, 2002; Tukker, 2004; Roos, 2016). This may entail educating the market to some extent with a view to stimulating the ICT services sub-sector to develop more business for the manufacturing industry and to accompany the latter in its international business (piggy-backing). This is an avenue that is currently being considered in the Basque Country (see the Bind 4.0 initiative)28, as well as in the manufacturing heartlands of Germany, where it is also believed necessary to stimulate bonds between mid-sized production firms and digital companies (Demary et al., 2016).

Following on from the discussion of results that we provided under section 4, a series of practical recommendations can be formulated to strengthen the position of the Basque ICT services sub-sector. These can be summarized as follows:

|

Through B2B relations with the manufacturing industry |

Through B2B relations with the services sector |

Through actions by the ICT sub-sector itself |

|

Forge further ties (including outsourcing dynamics) with industrial actors that incorporate ICT services into their value propositions |

Raise awareness of the importance of the services sector as an outlet for ICT services and products |

Pursue their own internationalization agenda |

|

Encourage industrial actors to offer product–service systems |

Strengthen proximity to (inter)national service players |

Grow the industrial / product part of the ICT sub-sector (‘productization’) |

|

Encourage industrial actors to digitalize their offers and to practise smart servitizationi |

Expand scale and geographical coverage of operations |

Increase the vertical specialization of ICT agents |

i.With a view to seizing the opportunities that the digital transformation and Industry 4.0 processes of manufacturing firms can offer to the ICT sector.

Tab. 3 – Strategic options for expanding the (inter)national

business of the Basque ICT services sub-sector.

Source: Prepared by the authors.

146Note that we recommend supplementing follow-the-(industrial)-clients abroad tactics with the ICT sub-sector undertaking its own initiatives to internationalize. Similarly, we stress the importance of forging ties with the service sector as a demand vector for ICT services and products, as well as the importance of generating more ‘vertically specialized’ ICT services activities. This can also enable ICT agents to gain a firmer international foothold. We also encourage reinvigorating the industrial/product part of the Basque ICT sub-sector as a means to improve the development potential of the ICT services sub-sector.

Conclusions and suggestions

for future research

As a form of conclusion, we can state that the bond between the ICT services sub-sector and the manufacturing industry from the Basque Country is underdeveloped, which implies that the bond between the two may not be as strong as mainstream literature on KIBS leads us to think. This may not be a reason to question the value of KIBS for industry, but it does hint at the possibility that certain regions may shelter industries that rely more on in-house KISA and ICT capacities than on external providers of KIBS and ICT services.

In terms of limitations to the findings of our research; we acknowledge the aforementioned implications are derived from findings of a quantitative nature, and the interpretations we arrive at may be improved by conducting further qualitative research on the issues at hand. As such, the numerical approach that we applied to the paper’s research questions limits the certainty with which we can answer them. We thus recommend conducting qualitative follow-on research, either in the form of case study research and/or a survey among ICT firms from the Basque Country to assess whether our conjectures are plausible or need to be adapted. We likewise recommend exploring similar questions in other (Spanish or European) regions in order to produce cross-case comparisons between regional complexes.

147In terms of suggestions for future research, we reckon that it would be of interest to conduct econometric analyses of the data we have used. For this, the fact that different classification schemes were utilized over the course of the time span did represent a handicap. Finding ways to deal with this issue could certainly improve the analyses performed and the robustness of certain findings.

148References

Acatech (2015), Smart Service Welt, Frankfurt am Main, Acatech.

Antonelli C. (1998), “Localized technological change, new information technology and the Knowledge-Based Economy: the European evidence”, Journal of Evolutionary Economics, vol. 8, no 2, p. 177-198.

Baker P. (2007), “The impact of business services use on client industries: evidence from input–output data”, in Rubalcaba L. and Kox H.L. (eds), Business services in European economic growth, Basingstoke, New York, Palgrave Macmillan, p. 97-115.

Borowik I.M. (2014), “Knowledge Exchange Mechanisms and Innovation Policy in Post-Industrial Regions: Approaches of the Basque Country and the West Midlands”, Journal of the Knowledge Economy, vol. 5, no 1, p. 37-69.

Brenner T., Capasso M., Duschl M., Frenken, K. and Treibich T. (2017), “Causal relations between knowledge-intensive business services and regional employment growth”, Regional Studies, vol. 52, no 2, p. 172-183.

Brettel M., Friederichsen N., Keller M. and Rosenberg M. (2014), “How Virtualization, Decentralization and Network Building Change the Manufacturing Landscape: An Industry 4.0 Perspective”, International Journal of Mechanical, Aerospace, Industrial, Mechatronic and Manufacturing Engineering, vol. 8, no 1, p. 37-44.

Camacho J.A. and Rodriguez M. (2007), “Integration and diffusion of KIS for industry performance”, in Rubalcaba L. and Kox H.L. (eds), Business services in European economic growth, Basingstoke, New York, Palgrave Macmillan, p. 128-143.

Cooke P.N. and Memedovic O. (2003), Strategies for Regional Innovation Systems: Learning Transfer and Applications, UNIDO Policy Paper, United Nations Industrial Development Organization (UNIDO), Vienna.

Corrocher N. and Cusmano L. (2014), “The ‘KIBS engine’ of regional innovation systems: empirical evidence from European Regions”, Regional Studies, vol. 48, no 7, p. 1212-1226.

Dachs B. (2010), Sectoral Innovation Foresight, Knowledge Intensive Services. Sectoral Innovation Watch, Task 2, European Commission, Brussels.

Dachs B., Biege S., Borowiecki M., Gunther L., Jager A. and Schartinger D. (2012), The Servitization of European Manufacturing Industries, Vienna, AIT.

Demary V., Engels B., Röhl K-H. and Rusche C. (2016), Digitalisierung und Mittelstand – Eine Metastudie, IW Analysen No 109, Köln.

149European Commission (2012), Knowledge-Intensive (business) services in Europe, European Commision, Brussels.

European Commission (2014), For a European Industrial Renaissance, SWD (2014) 14, Brussels, European Commission.

Evangelista R., Lucchese M. and Meliciani V. (2013), “Business services, innovation and sectoral growth”, Structural Change and Economic Dynamics, vol. 25, no C, p. 119-132.

Feser D. and Proeger T. (2015), Knowledge-intensive business services as credence goods – a demand-side approach, Georg-August Universität Göttingen Discussion Papers, no 232, February.

Foment del Treball Nacional (2017), Incidencia del escenario político en la actividad económica y empresarial, Barcelona.

François J. and Hoekman B. (2010), “Services Trade and Policy”, Journal of Economic Literature, vol. 48, no 3, p. 642-692.

François J., Manchin M. and Tomberger P. (2015), “Services linkages and the value added content of trade”, The World Economy, vol. 38, no 11, p. 1631-1649.

Freiling J., Wassermann R. and Laudien S.M. (2012), “The broken product chain: rapid paths of service internationalization in terms of the service-dominant logic”, The Service Industries Journal, vol. 32, no 10, p. 1623–1635.

Gallego J. and Maroto A. (2013), “The Specialization in Knowledge-Intensive Business Services (KIBS) across Europe: Permanent Co-Localization to Debate”, Regional Studies, vol. 49, no 4, p. 644-664.

Gallouj F. (2002), “Innovation in services and the attendant old and new myths”, Journal of Socio-Economics, vol. 31, no 2, p. 137-154.

Gotsch M., Hipp C., Gallego J., and Rubalcaba L. (2011), Sectoral Innovation Watch — Knowledge Intensive Services, Final Sector Report, European Commission, Brussels.

Guerrieri P. and Meliciani V. (2003), “International competitiveness in producer services”, Paper prepared for the SETI meeting, Roma, May.

Henneberg S., Gruber Th. and Naudé P. (2013), “Services networks: Concept and research agenda”, Industrial Marketing Management, vol. 42, no 1, p. 3-8.

IDEA (2013), Étude relative à la caractérisation des relations interindustrielles en Wallonie et au positionnement de l’industrie wallonne au sein des chaînes de valeur mondiales – Une vision prospective, IDEA, Brussels.

Jacobs W., Van Rietbergen T., Atzema O., Van Grunsven L. and Van Dongen F. (2016), “The Impact of Multinational Enterprises (MNEs) on Knowledge-Intensive Business Services (KIBS) Start-ups: Empirical Evidence from the Dutch Randstad”, Regional Studies, vol. 50, no 4, p. 728-743.

Jensen M., Johnson B., Lorenz E. and Lundvall B.-A. (2007), “Forms of knowledge and modes of innovation”, Research Policy, vol. 36, no 5, p. 680-693.

150Kamp B. and Alcalde H. (2014), “Servitization in the Basque economy”, Strategic Change, vol. 23, no 5-6, p. 359-374.

Kamp B. and Bevis K. (2012) “Knowledge Transfer Initiatives as a Doorstep Formula to Open Innovation”, International Journal of Automotive Technology and Management, vol. 12, no 1, p. 22-54.

Kamp B. and Ruiz de Apodaca I. (2017), “Are KIBS beneficial to international business performance Evidence from the Basque Country”, Competitiveness Review: An International Business Journal, vol. 27, no 1, p. 80-95.

Kamp B., Sisti E. (2017), “Evolutions among Basque manufacturing industry in terms of service-based turnover”, Paper presented at RESER 2017 conference, Bilbao, August.

Koch A., Strotmann H. (2008), “Absorptive capacity and innovation in the knowledge intensive business service sector”, Economics of Innovation and New Technology, vol. 17, no 6, p. 511-531.

Konstantynova A. (2017), “Basque Country cluster policy: the road of 25 years”, Regional Studies, Regional Science, vol. 4, no 1, p. 109-116.

Kowalkowski C., Kindström D. and Gebauer H. (2013), “ICT as a Catalyst for Service Business Orientation”, Journal of Business & Industrial Marketing, vol. 28, no 6, p. 506-513.

Kox H.L., Rubalcaba L. (2007), “The contribution of business services to economic growth”, in Rubalcaba L. and Kox H.L. (Eds), Business services in European economic growth, Basingstoke, New York, Palgrave Macmillan, p. 97-115.

Martinez-Arguelles S.R. and Rubiera-Morollon F. (2006), “Outsourcing of advanced business services in the Spanish economy: Explanation and estimation of the regional effects”, The Service Industries Journal, vol. 26, no 3, p. 267-285.

Miles I. (2003), Knowledge Intensive Services’ Suppliers and Clients, Ministry of Trade and Industry Finland, Studies and Reports.

Minondo A.M. (2016), “Exporters of knowledge-intensive business services in Basque Country”, Ekonomiaz – Revista vasca de Economía, vol. 90, no 2, p. 320-337.

Müller E. and Zenker A. (2001), “Business services as actors of knowledge transformation: the role of KIBS in regional and national innovation systems”, Research Policy, vol. 30, no 9, p. 1501-1516.

Navarro M. (2010), Reflexiones sobre el sistema y las políticas de innovación del País Vasco, Orkestra Working Paper Series in Territorial Competitiveness, San Sebastian.

Nepelski D. and de Prato G. (2014), “European ICT Poles of Excellence – The Geography of European ICT Activity and Its Policy Implications”, Intereconomics: Review of European Economic Policy, vol. 49, nº 6, p. 324-331.

151Ollo-López A. and Aramendía-Muneta M.E. (2012), “ICT impact on competitiveness, innovation and environment”, Telematics and Informatics, vol. 29, nº 2, p. 204-210.

Orkestra (2014), PYME2025 Project Report for Basque Government, San Sebastian.

Ostrom A.L., Bitner M.J., Brown S.W., Burkhard K.A., Goul M., Smith-Daniels V., Demirkan H. and Rabinovich E. (2010), “Moving Forward and Making a Difference: Research Priorities for the Science of Service”, Journal of Service Research, vol. 13, nº 1, p. 4-36.

Porter M.E. (1990), The competitive advantage of nations, New York, Free Press.

Rodriguez M. and Camacho J.A. (2016), “Knowledge – intensive business services in Smart specialisation: are they relevant actors?”, Paper presentation for the SMARTER conference, Seville, 28-30 September.

Roos G. (2016), “Manufacturing: Facts, Trends and Implications”, Ekonomiaz – Revista vasca de Economía, vol. 80, nº 1, p. 26-55.

Savic M. (2016), “What role for knowledge-intensive business services (KIBS) in de-industrialized regions?”, Regional Studies, Regional Science, vol. 3, nº 1, p. 445-454.

Shearmur R. and Doloreux D. (2008), “Urban hierarchy or local buzz? High-order producer service and (or) knowledge-intensive business service location in Canada, 1991–2001”, Professional Geographer, vol. 60, nº 3, p. 333-355.

Strambach S. (2008), “Knowledge-intensive business services (KIBS) as drivers of multilevel knowledge dynamics”, International Journal of Service Technology and Management, vol. 10, nº 2-4, p. 152–174.

Thomi W. and Böhn T. (2003), “Knowledge intensive business services in regional systems of innovation. Initial results from the case of Southeast-Finland”, 43rd European Congress of the Regional Science Association, Jyväskylä, Finland, 27-30 August.

Tödtling F., Lehner P. and Kaufmann A. (2009), “Do Different Types of Innovation Rely on Specific Kinds of Knowledge Interactions?”, Technovation, vol. 29, nº 1, p. 59-71.

Tukker A. (2004), “Eight Types of Product– Service System: Eight Ways To Sustainability? Experiences From Suspronet”, Business Strategy and the Environment, vol. 13, nº 4, p. 246-260.

Valdaliso J.M., Elola A., Aranguren M.J. and López S. (2012), “Social Capital, Knowledge, and Competitiveness: The Cases of the Basque Paper and Electronics/ICT Clusters», in Asheim B.T. and Parrilli M.D. (eds.), Interactive Learning for Innovation, London, Palgrave Macmillan, p. 161-180.

Zubillaga A. (2018a), El sector TEIC tras la crisis, Orkestra-Digital Economy Lab, Bilbao.

Zubillaga A. (2018b), Economia y Sociedad digitales en el Pais Vasco, Orkestra-Digital Economy Lab, Bilbao.

1 This work was supported by the Urban Innovative Actions grant UIA01-060 Bilbao As Fabrik.

2 Corresponding author

3 A full overview of the NACE 2009 codes related to the ICT services and ICT production sectors in question can be found at the following link: http://es.eustat.eus/document/industria_TIC_c.html.

4 See: http://www.eustat.eus/banku/id_4111/indexLista.html.

5 See: http://ec.europa.eu/competition/mergers/cases/index/nace_all.html.

6 See: http://www.eustat.eus/documentos/codigos_c.html under the section titled ‘Clasificación de actividades’.

7 See: http://www.eustat.eus/banku/id_3438/indexLista.html.

8 See: http://ec.europa.eu/competition/mergers/cases/index/nace_all.html.

9 See: http://ec.europa.eu/competition/mergers/cases/index/nace_all.html.

10 RHS = see right hand scale; LHS = see left hand scale. – NACE 2009 codes corresponding to the manufacturing industry = C10–33.

11 These are regions that Orkestra-Basque Institute of Competitiveness considers to be comparable to the Basque Country in terms of overall productive structure.

12 Eustat: Industrial statistics, A86 classification - sub-sectors 5–41 for the manufacturing industry.

13 Eustat: Input–Output tables. For the 2000–2009 period, product code 81 (computer activities), and for the 2010–2014 period, code 77 (computer and information services). – Note that due to methodological changes in the European System of Accounts (known as ESA 2010), how input–output relationships were reported underwent changes. This makes it difficult to construct a homogeneous time series across the period for which Eustat has data. Consequently, we present the corresponding results for two separate time frames, the 2000–2009 and 2010–2015 periods, respectively.

14 RHS = see right hand scale; LHS = see left hand scale.

15 Note that local ICT services form the main supply source for the Basque manufacturing industry, representing 85 % or more of total ICT services consumption throughout the time span considered.

16 RHS = see right hand scale; LHS = see left hand scale.

17 Eustat: Foreign Trade statistics ECOMEX, A86 classification - sub-sectors 5–41 for the manufacturing industry.

18 This ratio is higher than the one for expenditure on local ICT services by the manufacturing industry and turnover for the manufacturing industry, since only a small part of turnover comes from exports.

19 Similarly to the previous figures, due to recent methodological changes made in the European System of Accounts (known as ESA 2010), the results for sales destinations are presented for two separate time frames, the 2000–2009 and 2010–2014 periods, respectively.

20 For these figures as well, the transition from 2009 to 2010 is problematic in the sense that sales levels in 2009 and 2010 do not align (for any of the four geographic sources). Nonetheless, in the interests of trend analysis, the available data do provide useful insights.

21 RHS = see right hand scale; LHS = see left hand scale.

22 To avoid using the term ‘service’ too frequently and to avoid confusion, in this section we also refer to the service sector as the ‘tertiary sector’.

23 Once more, due to recent methodological changes made in the European System of Accounts (known as ESA 2010), we are forced to present the results for two separate time frames, the 2000–2009 and 2010–2014 periods, respectively.

24 RHS = see right hand scale; LHS = see left hand scale.

25 Of course, there may be certain pockets of specialization as a result of particular ICT service–manufacturing activities interactions, but these are likely to be of limited size.

26 www.clusterobservatory.eu.

27 This is in line with the trends that have emerged since the second half of 2017 in Catalonia, where – as a consequence of political aspirations for independence – banking and insurance companies in particular decided to move their corporate headquarters to more central cities within Spain (Foment del Treball Nacional, 2017).

28 https://bind40.com/